Recently, the Congressional Budget Office (CBO) released its latest statistics on income inequality. Economists, bloggers and others have been furiously debating their implications. Over at the American Enterprise Institute, Jim Pethokoukis has been bludgeoned by various left-wing bloggers for pointing out that the story of growth of income inequality is much more complicated than the simple version spun by the CBO, and that there exists a considerable amount of evidence that income inequality hasn’t gotten worse since the ‘90s.

His arguments can be read here, here and here.

One point that gets overlooked, however, is that income is only a part of the issue, and not a very comprehensive measure of prosperity. Wealth sums an individual’s total command over resources, whereas income reflects only the resources acquired over a given period. Thus wealth is a much broader and more meaningful measure of prosperity than income. It includes things such as financial and nonfinancial assets, including bank accounts, investments, houses, cars and debt.

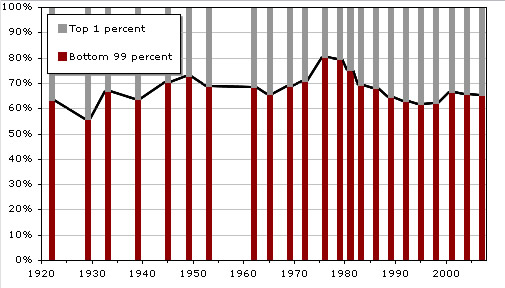

Alan Reynolds reminds readers that the left repeatedly cites income figures from a famous study by economist Emanuel Saez, which show that top earners’ share of income has increased. Yet the left never cites figures from another study by Saez on wealth inequality, which show that top earner’s share of wealth at the beginning of the 21st century is lower than it was in the early 1900s.

In fact, in the opening pages of his study, Saez writes:

Top wealth shares were very high at the beginning of the period but have been hit sharply by the Great Depression, the New Deal, and World War II shocks. Those shocks have had permanent effects. Following a decline in the 1970s, top wealth shares recovered in the early 1980s, but they are still much lower in 2000 than in the early decades of the century.

Other wealth data confirm this:

It’s easy to get lost in the cacophony of numbers and statistics thrown around by all sides in the income inequality debate. Just remember that wealth concentration has declined among top earners, even according to the very economist the left generally cites to argue that income inequality has grown. That wealth data reflect a decline in concentration at the top over the past hundred years should indicate that reaching conclusions about inequality using income data is at best an incomplete assessment.