EconomyNews

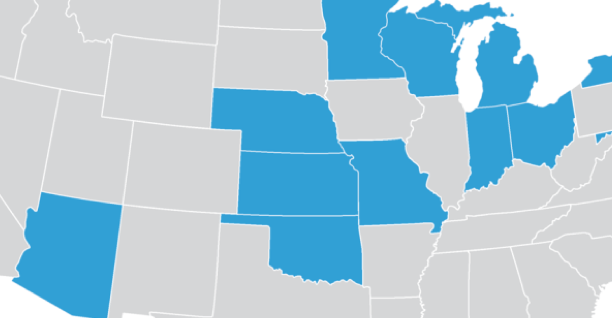

14 States Cut Taxes in 2014. Is Yours One of Them?

With Wisconsin leading the way, 14 states enacted “significant, broad-based tax cuts” in 2014, according to a report released this week. Surprisingly, several states controlled… Read More