EconomyCommentary

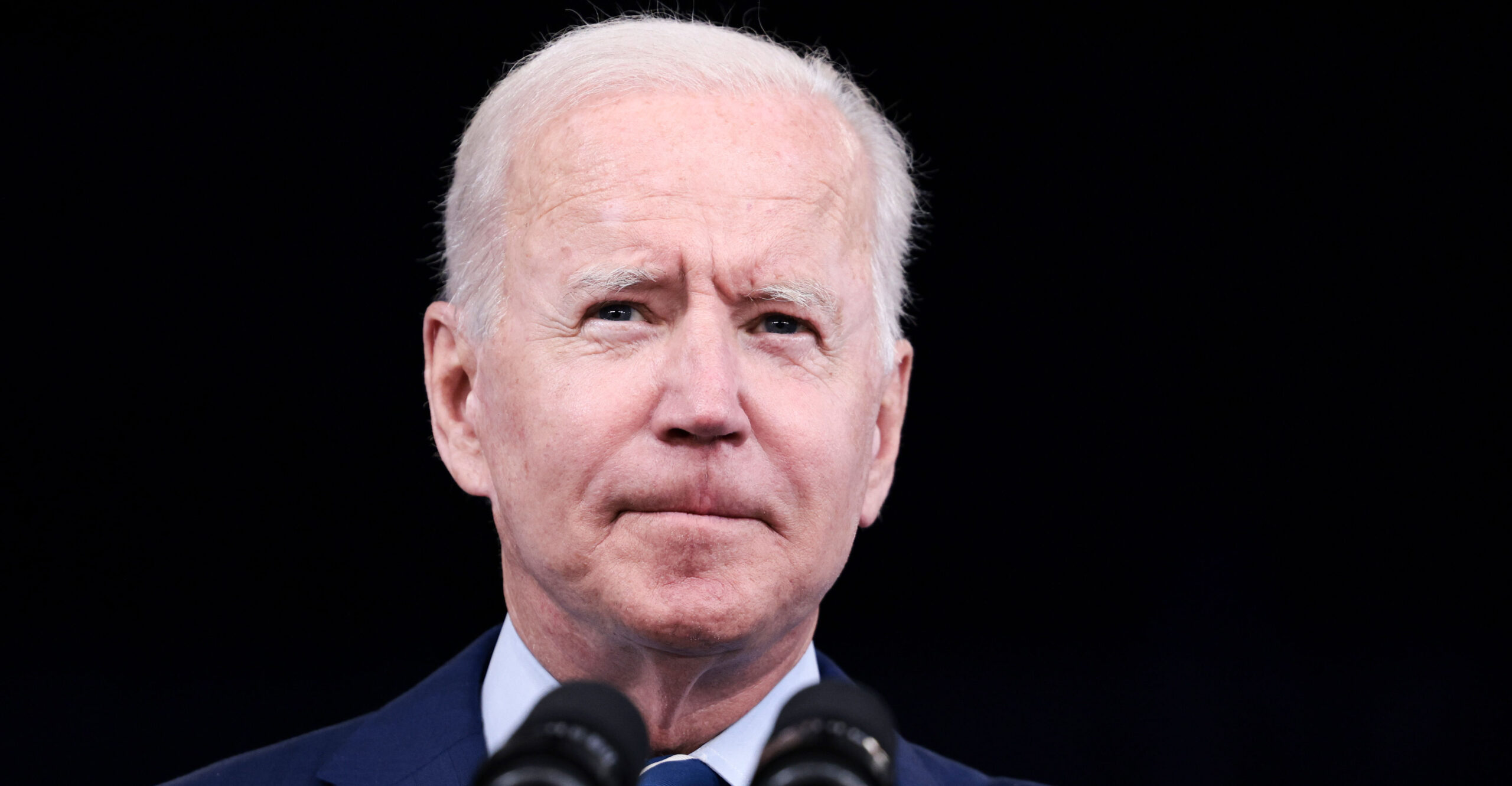

Vaccine Mandates Aren’t Biden’s Only Job-Killing Scheme

Despite $9 trillion in fiscal and monetary stimulus from the federal government, America has an employment problem. The Labor Department estimates that 10.4 million jobs… Read More