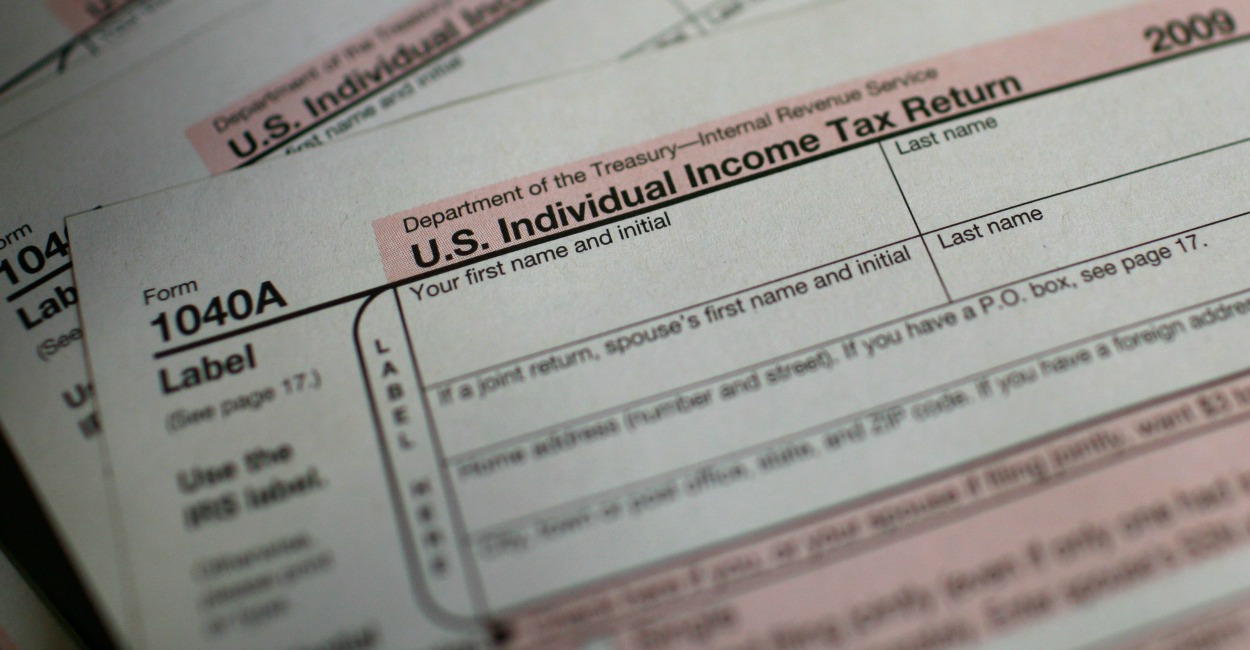

EconomyNews

IRS Policy That Allowed Targeting Is Still in Effect, Watchdog Finds

An obscure bureaucratic policy that allowed IRS officials to target conservative and tea party tax-exemption applicants during the 2010 and 2012 election campaigns is still in… Read More