EconomyNews

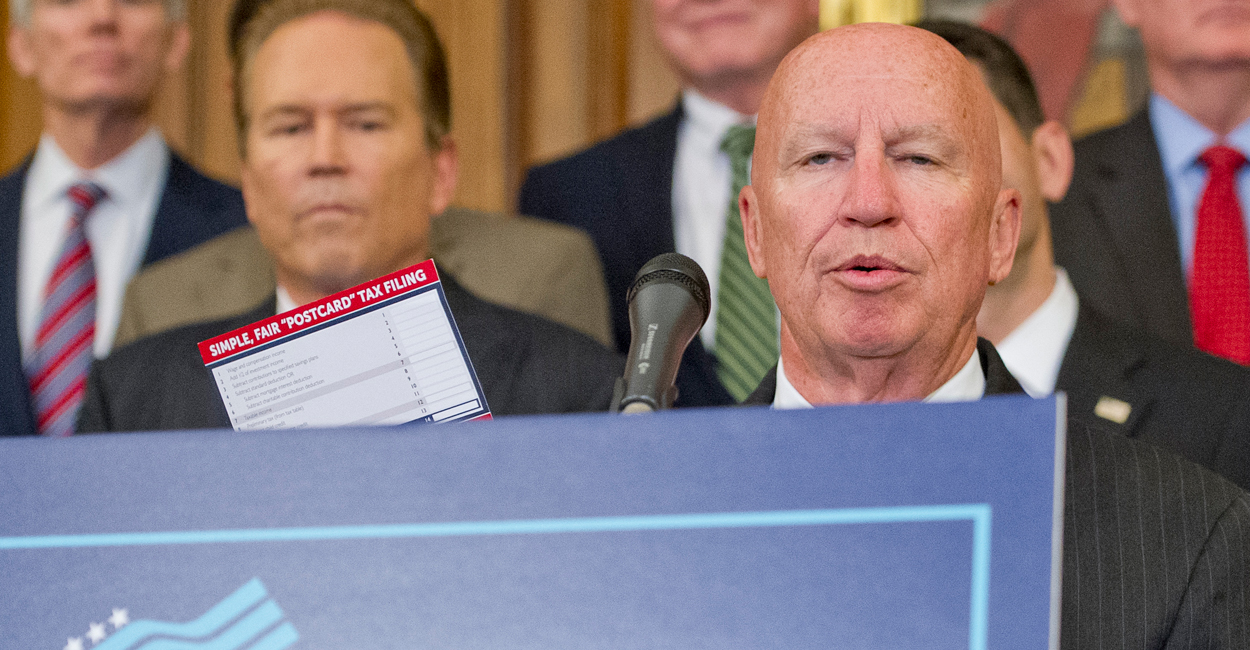

New Report: GOP Tax Reform Could Boost Household Income by $4,000

A study released Monday by the president’s Council of Economic Advisers found that congressional Republicans’ tax reform framework would produce thousands of dollars in income… Read More