SocietyCommentary

How Discriminatory DEI Ideology Spreads in Federal Bureaucracy

If you’re like most Americans, you’ve heard the acronym DEI. You also may know that it stands for diversity, equity, and inclusion. What you may… Read More

SocietyCommentary

If you’re like most Americans, you’ve heard the acronym DEI. You also may know that it stands for diversity, equity, and inclusion. What you may… Read More

PoliticsCommentary

America’s financial mismanagement has gotten so bad that some say our country’s decline is now inevitable, drawing parallels to the Roman Empire’s collapse. That comparison… Read More

SocietyNews

A 95-year-old veteran of the Korean War says he received less than two months’ notice that he had to move out of a nursing home… Read More

PoliticsNews

The American Right needs to revitalize itself after a generation of decay where the Left took control over most of the corporate sector, the military,… Read More

LawCommentary

School isn’t the only thing back in session this fall. The Supreme Court will resume hearing cases when its new term begins Oct. 2. So,… Read More

EconomyCommentary

Want a soda? You’ll pay more for one in Philadelphia, because five years ago, local politicians decided to tax it. They’re “protecting” people, they said…. Read More

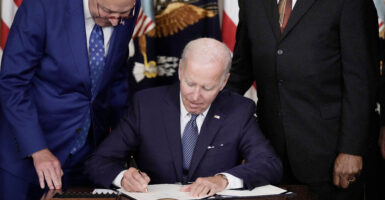

EconomyCommentary

The middle class is demonstrably worse off under President Joe Biden, but that hasn’t stopped him from spending 40% of his presidency on vacation. Many Americans… Read More

EconomyCommentary

Just because the government raises taxes, doesn’t necessarily mean it will raise more revenues. The Biden administration is discovering that the hard way. In August… Read More

EducationCommentary

It’s back to school this week for Florida students and many others across the country. The first days and weeks of a new school year… Read More

SocietyCommentary

You don’t need a college degree to understand what’s happening in our country. Oliver Anthony, the Virginia songwriter and singer behind the viral hit “Rich… Read More