EconomyCommentary

South Dakota Republicans Push for Higher Taxes

President Donald Trump may have spearheaded a large tax cut late last year, but two members of his party apparently prefer that Americans pay more…. Read More

EconomyCommentary

President Donald Trump may have spearheaded a large tax cut late last year, but two members of his party apparently prefer that Americans pay more…. Read More

LawCommentary

Should online retailers have to collect sales taxes for states? That’s the central question in South Dakota v. Wayfair, a case dealing with the state’s… Read More

EconomyAnalysis

Today is Tax Freedom Day, and The Heritage Foundation’s Adam Michel joins us to discuss that, tax reform 2.0, and how your taxes will be… Read More

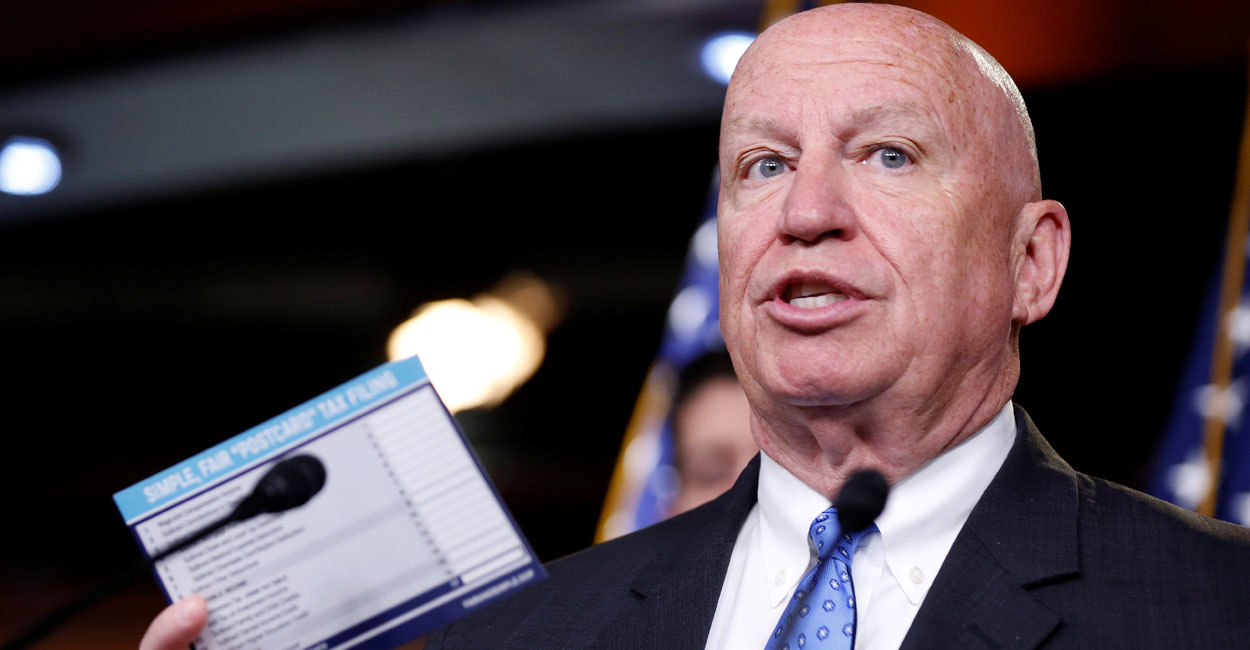

EconomyNews

House Ways and Means Chairman Kevin Brady, R-Texas, sat down with The Daily Signal to talk about the historic tax reform package passed by Congress and… Read More

EconomyNews

House Ways and Means Chairman Kevin Brady, R-Texas, says he wants tax reform 2.0 to be about creating a culture of reform so that the… Read More

EconomyCommentary

Tax Day is right up there with “Root Canal Day” in terms of days that no one wants to celebrate. But this year we’re turning… Read More

EconomyCommentary

Say your fond farewells, because this April marks the last year you will have to pay your taxes under the old tax code. Next year,… Read More

EconomyCommentary

Last month rapper Cardi B asked a slightly more profane version of the same question many Americans ask when they file their taxes. “Uncle Sam,… Read More

EconomyNews

President Donald Trump touted the success of his policies in helping manufacturers, and announced a new presidential order to roll back environmental regulations that would… Read More

EconomyCommentary

Donald Trump achieved the presidency telling the American people he would “Make America Great Again.” Given that during eight years of Barack Obama’s presidency there… Read More