EconomyNews

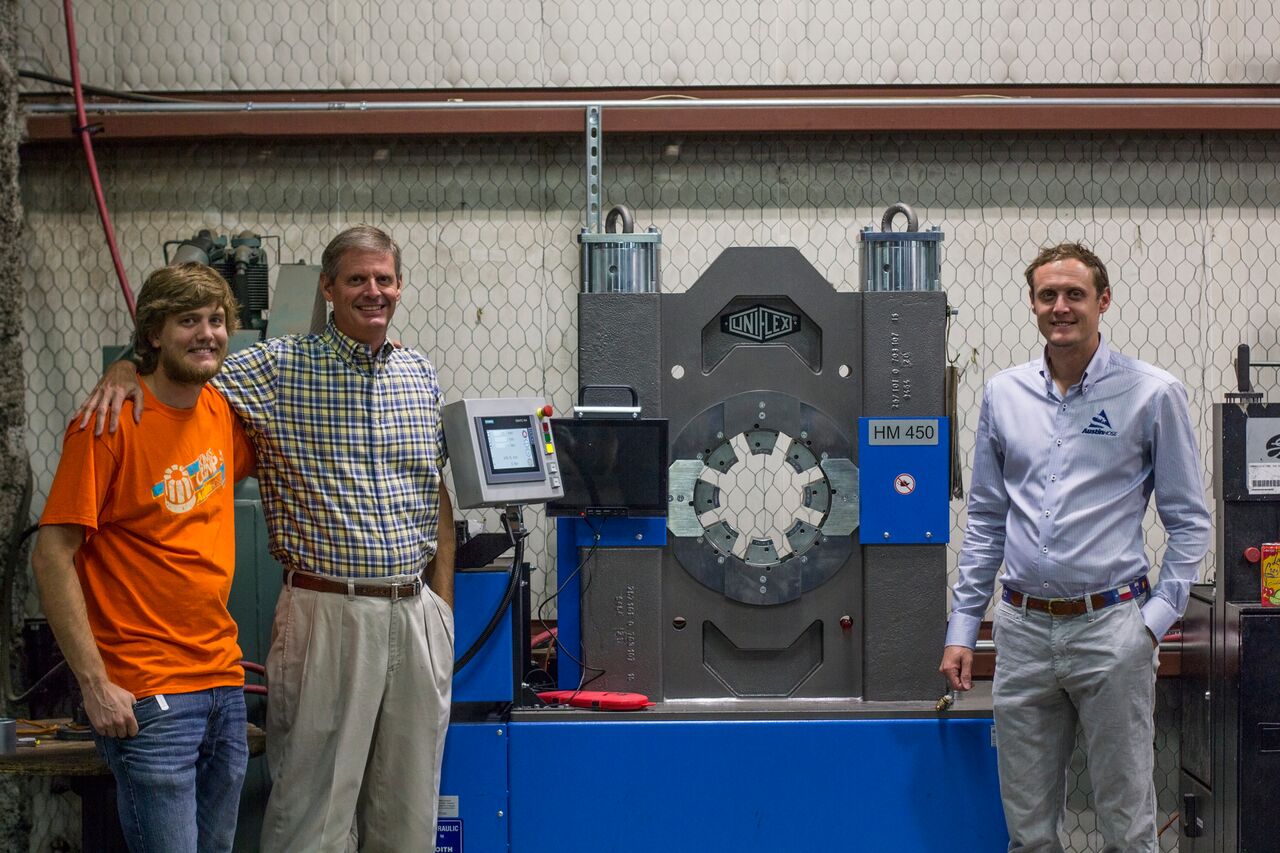

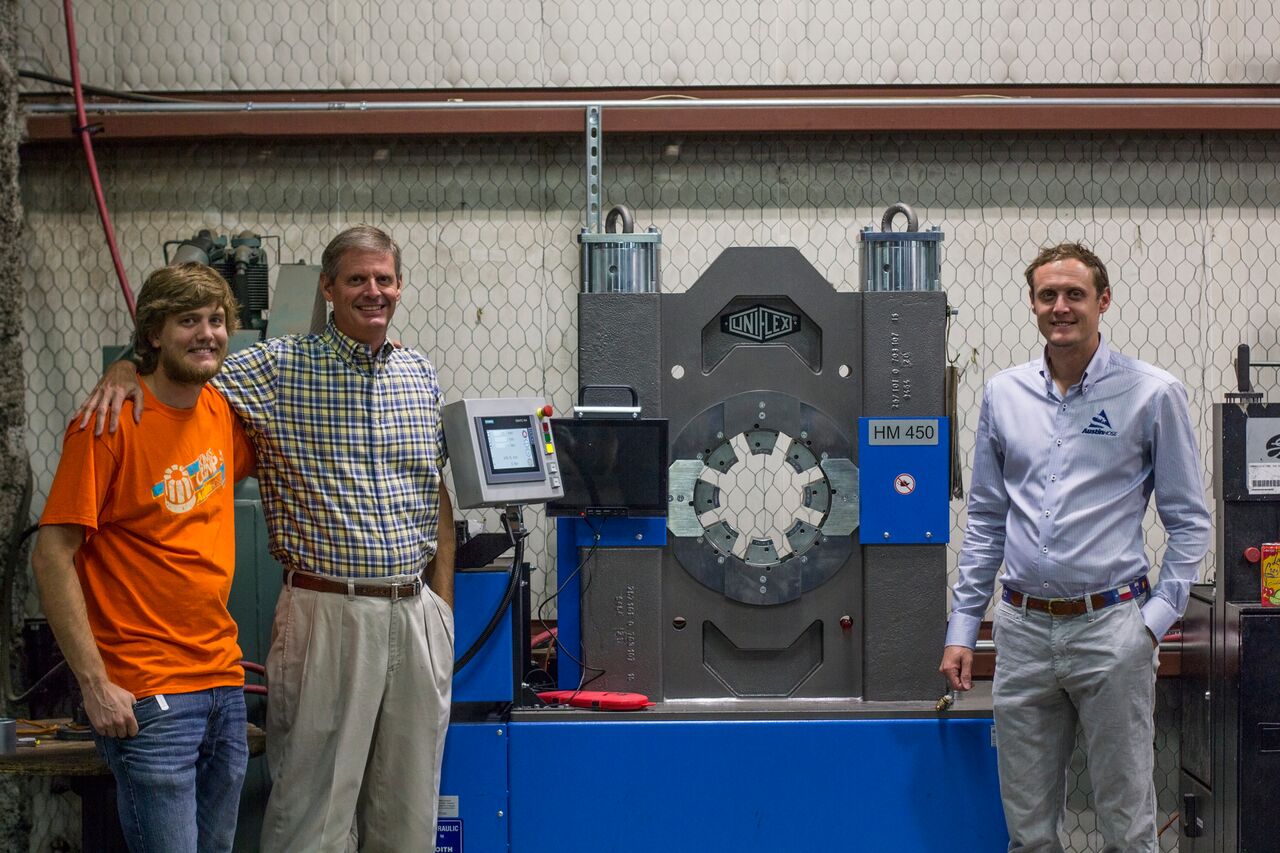

Tax Reform Spurs a Doubling of This Texan’s Business

Republican-passed tax reform has helped to more than double his supply company’s business, a Texas entrepreneur says. “The tax reform took our taxes from 34… Read More

EconomyNews

Republican-passed tax reform has helped to more than double his supply company’s business, a Texas entrepreneur says. “The tax reform took our taxes from 34… Read More

EconomyCommentary

The 2017 tax reform bill has been a boon for American workers. In addition to the average household’s $1,400 tax cut this year, there are… Read More

EconomyCommentary

The Tax Cuts and Jobs Act is continuing to produce tangible benefits for Americans, growing the U.S. economy and making it more competitive for business investment… Read More

EconomyNews

NEW ORLEANS—Philip Gunn says he is trying to move more of his state’s citizens from dependency on government “freebies” to self-sufficiency and a lighter tax… Read More

EconomyNews

Lima Pallet Co. announced earlier this year it was adding 15 to 20 jobs as part of an expansion prompted by the 2017 tax-cut law—one… Read More

EconomyCommentary

It’s no secret that being speaker of the House comes with its challenges. Recently, however, I had the kind of day that makes it all… Read More

EconomyCommentary

In February 2017, U.S. House Ways and Means Committee Chairman Kevin Brady remarked at a conference on international tax competition, “Our blueprint delivers a tax… Read More

EconomyNews

HAGERSTOWN, Maryland—Tom Condon has seen Jamison Doors through many of the company’s ups and downs. A factory worker for 28 years, Condon has survived multiple… Read More

Commentary

“No taxation without representation.” It was the rallying cry of the American Revolution, and to this day remains printed on the license plates in Washington,… Read More

EconomyCommentary

You’ve probably heard about last year’s tax reform—the bill that cut Americans’ taxes in 2018 by about $1,400. What you might have missed is that… Read More