EconomyNews

Republican Senators Look to End Death Tax

Sens. Ted Cruz, R-Texas, and John Thune, R-S.D., reintroduced legislation this week to send the death tax to its grave. “Death should not be a… Read More

EconomyNews

Sens. Ted Cruz, R-Texas, and John Thune, R-S.D., reintroduced legislation this week to send the death tax to its grave. “Death should not be a… Read More

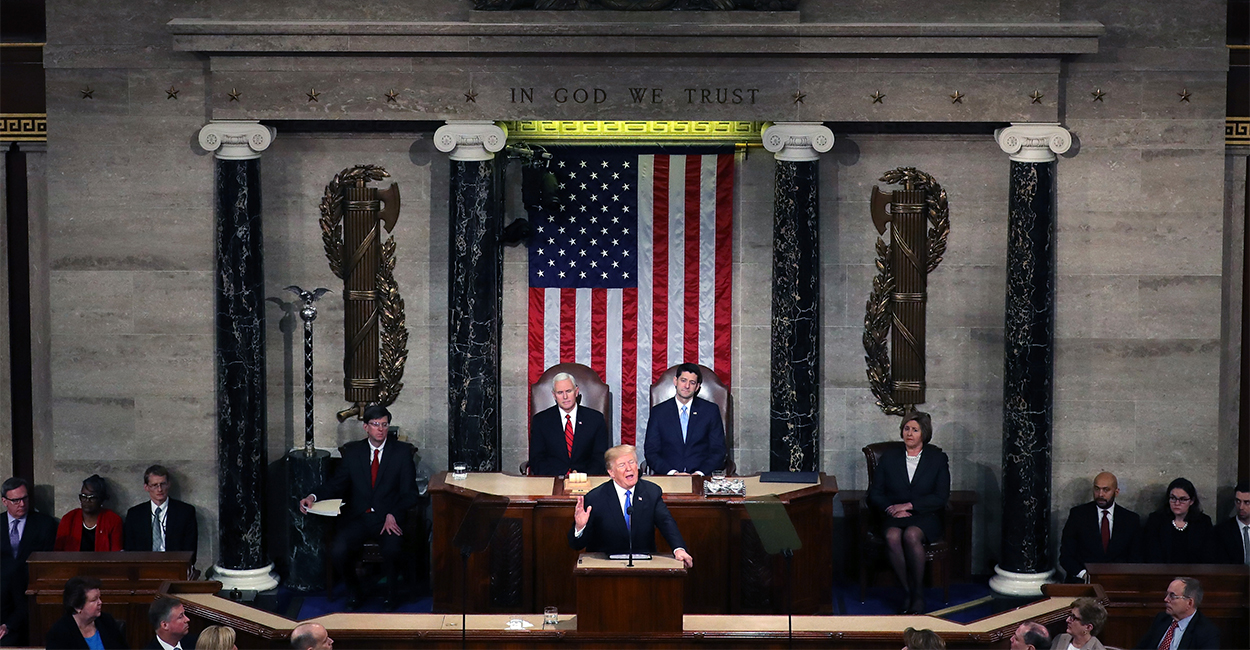

EconomyCommentary

With the shutdown over (at least for now), the State of the Union address is back “on.” When President Donald Trump takes the House podium on Feb. 5, you can count… Read More

EconomyNews

The White House is having internal discussions about the prospect of executive action by President Donald Trump to hold down capital gains taxes, said Larry… Read More

EconomyCommentary

A radical new tax proposal would hurt the poorest and more vulnerable working-class Americans, and fuel the ever-increasing presence of Washington in our daily lives…. Read More

EconomyCommentary

President Ronald Reagan was a winner who believed in the boundless potential of America. Sound familiar? It’s one of the reasons President Donald Trump is… Read More

EconomyCommentary

When you receive your paycheck and look at the withholding for federal, state, and sometimes city taxes, along with Social Security and Medicare, you probably… Read More

EconomyCommentary

Lower taxes and less regulation are great for business, but some are thriving in high-tax states like New York and California. On my new podcast,… Read More

EconomyNews

Seattle soda drinkers are paying nearly every penny of a tax on sugary drinks that the City Council put in place in January 2018, according… Read More

EconomyCommentary

Depending on who you listen to, the recent proposal by Rep. Alexandria Ocasio-Cortez, D-N.Y., to increase marginal income tax rates to 70 percent is either… Read More

EconomyAnalysis

If America’s auto manufacturers wrote letters to Santa, it’s not hard to guess what would be high on their lists: retaining the federal tax credit… Read More