EconomyNews

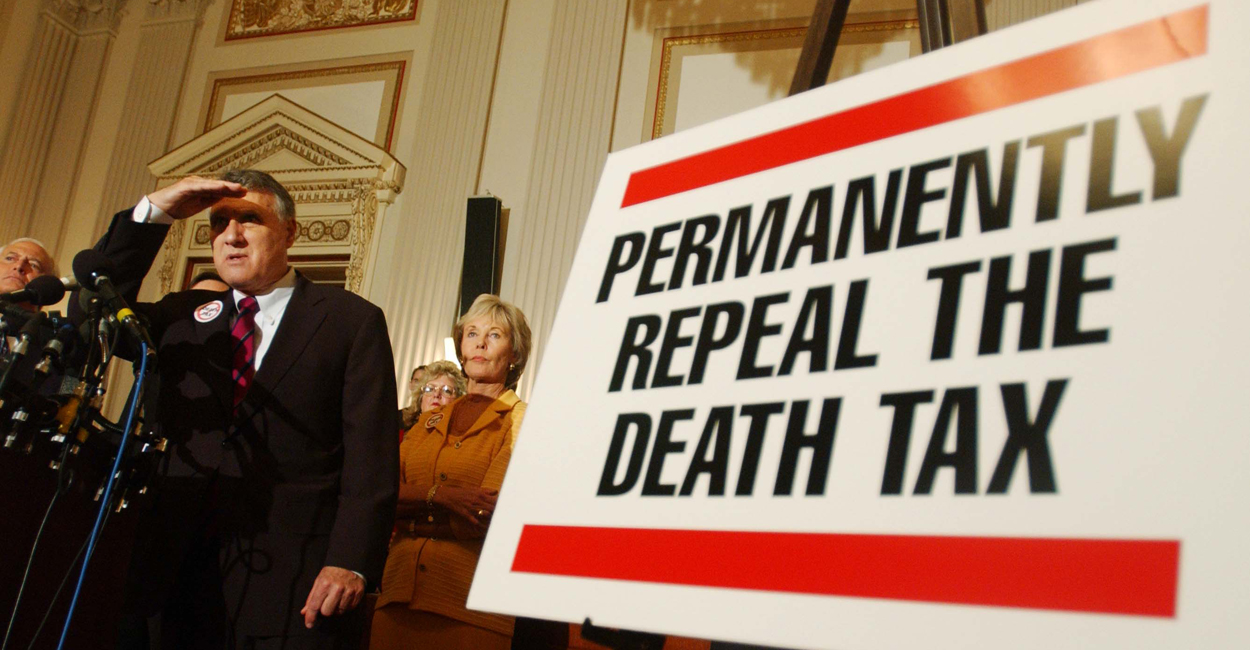

Tax Refunds Are on the Rise, Treasury Reports

Tax refunds have increased this week, the Treasury Department announced Thursday, after critics attacked the initial lower refunds that resulted from Americans paying less to… Read More