EconomyNews

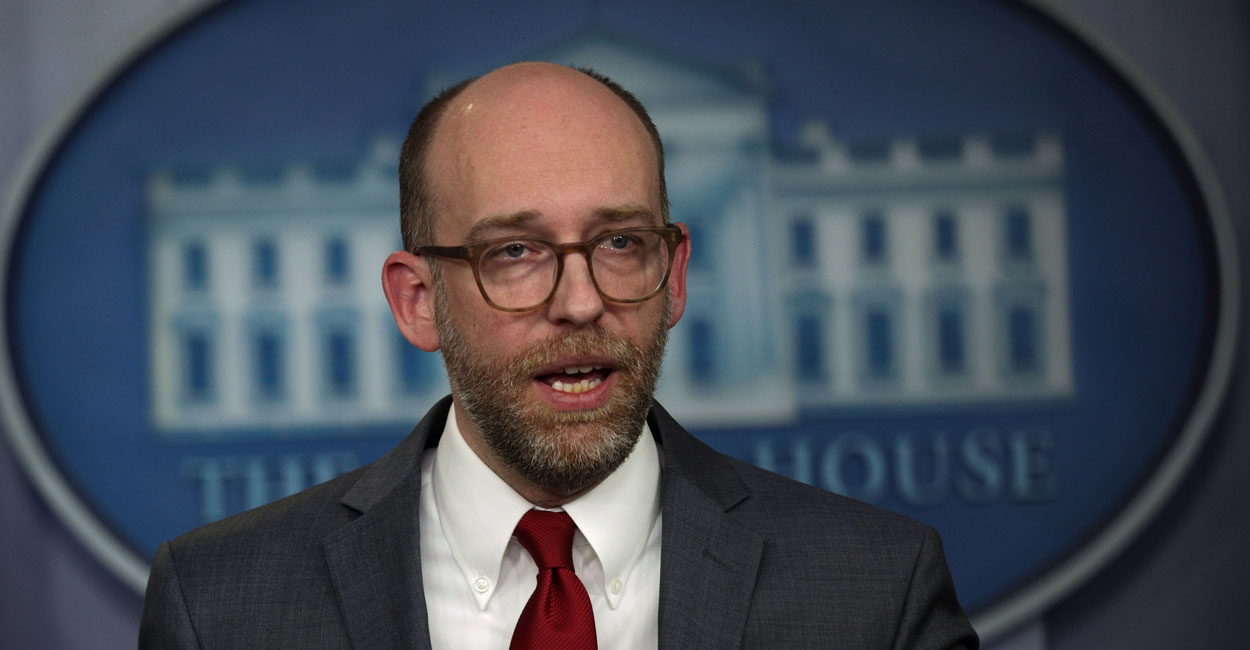

Budget Chief Prescribes Less Government Spending as Key to Draining Swamp

Fiscal responsibility is key to draining the swamp, the White House budget chief said Saturday in remarks to an annual gathering of conservative activists outside… Read More