LawNews

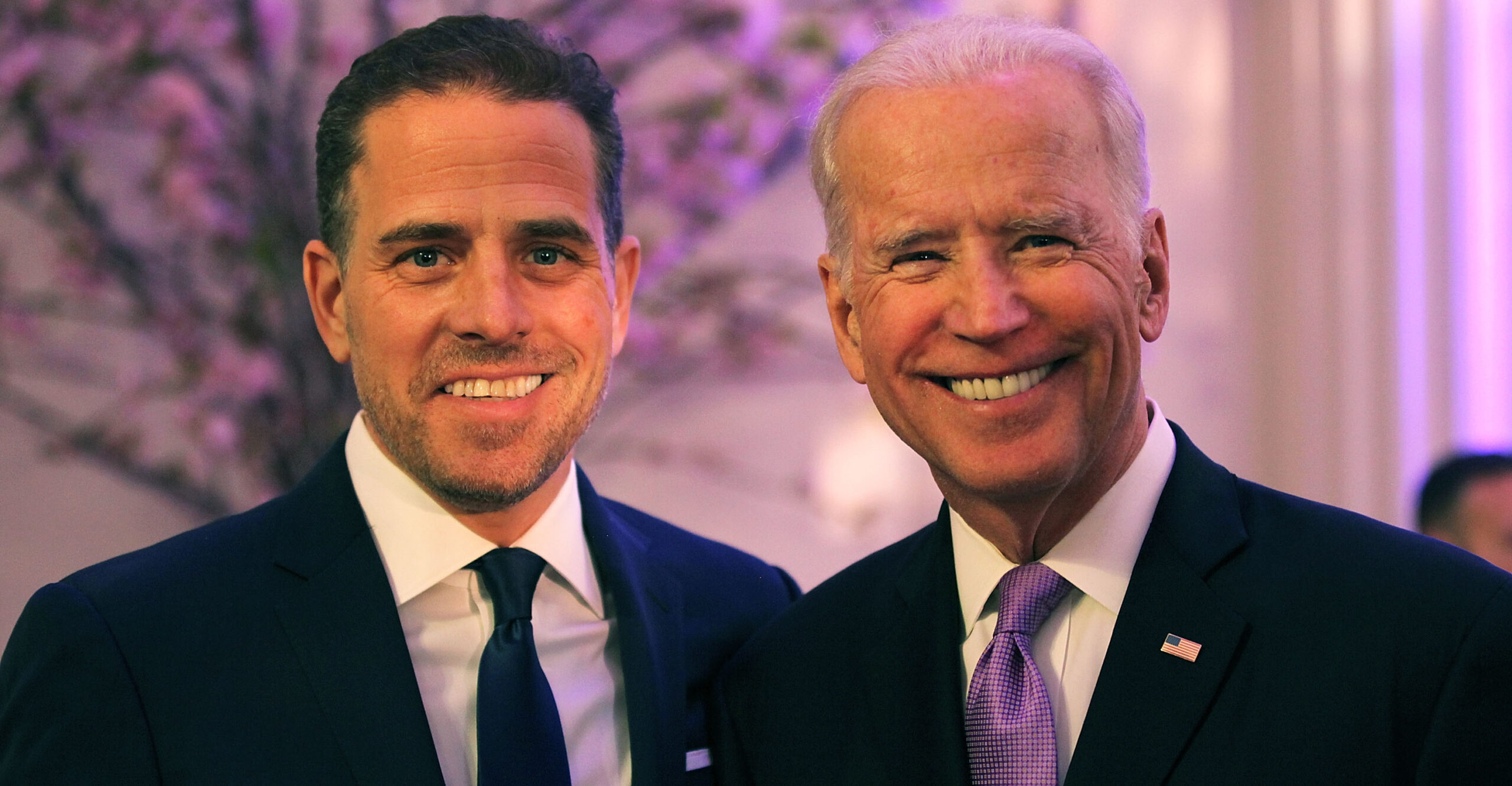

4 Points About the Federal Prosecutor Investigating Hunter Biden

The Justice Department’s investigation of Hunter Biden’s financial dealings is being led by a federal prosecutor who was appointed by President Donald Trump with the… Read More