EconomyNews

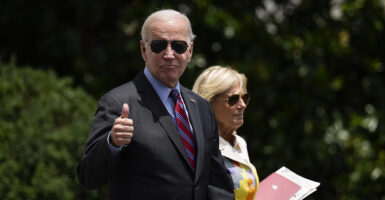

‘Economic Suicide’: Biden Admin Justifies Tax Hike Based on Racial Criteria

The Biden administration’s analysis of its revenue proposals for fiscal year 2025 argues targeted tax hikes that disproportionately affect white people would ease racial wealth inequality…. Read More