Chart of the Year: Entitlements and Interest Drive the Fiscal Crisis

The end of 2012 was marked by lawmakers engaging in a distracting fiscal cliff debate over tax rates when the solution to the real fiscal… Read More

The end of 2012 was marked by lawmakers engaging in a distracting fiscal cliff debate over tax rates when the solution to the real fiscal… Read More

The two lucky winners of the Powerball jackpot are a part of Powerball history. Of course, the winnings are subject to federal taxes, making the… Read More

On Friday, Representative Pete Sessions (R–TX) and House Speaker John Boehner (R–OH) ran afoul of Glenn Kessler’s “Fact Checker” blog regarding a study of President… Read More

On this Halloween, ghastly, ghoulish garb and haunted houses aren’t the only sources of spookiness in Washington. Americans across the country have cause for alarm,… Read More

The Congressional Research Service (CRS) released a report that should be a cause for concern to all who believe in limited government. In it, CRS… Read More

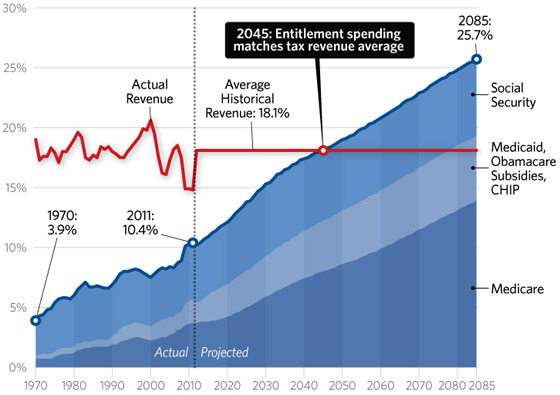

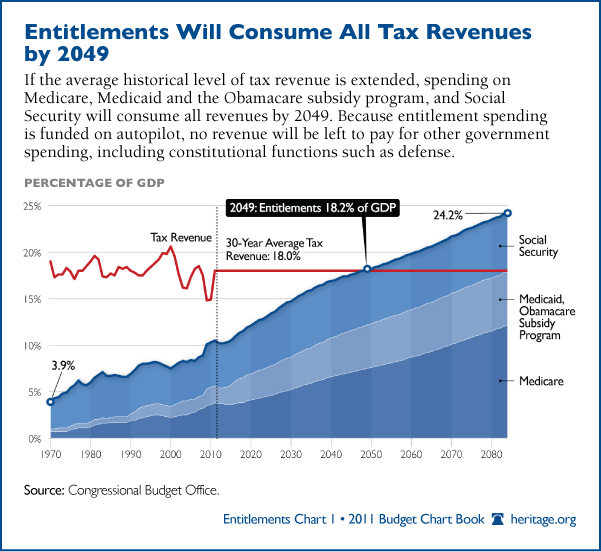

The looming unsustainability of the big three entitlement spending programs—Medicare, Medicaid, and Social Security—is not inevitable, but in order to avoid the catastrophic effects of… Read More

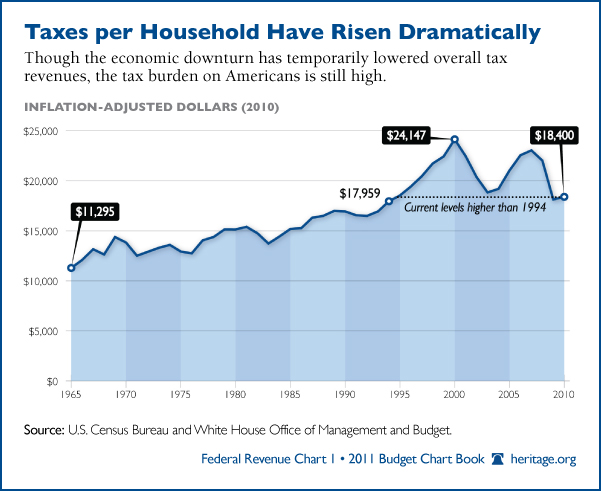

Americans who are scrambling to pay their taxes by Tuesday’s deadline are in store for more depressing news: The tax burden on American families has… Read More

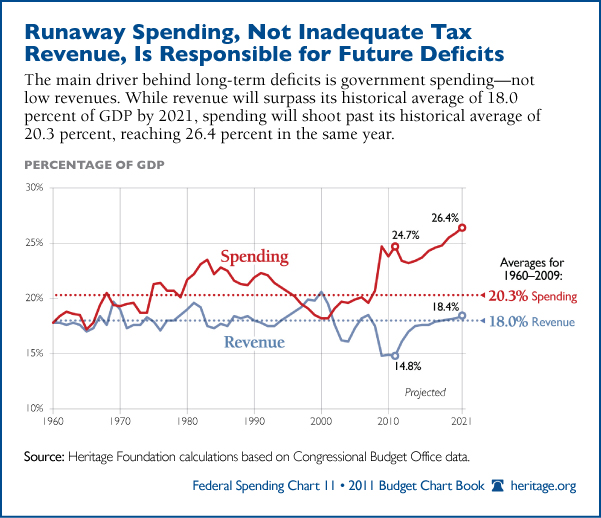

Following the failure of the Joint Select Committee on Deficit Reduction, Sen. Pat Toomey (R-PA) criticized liberals for insisting that any deal include a massive… Read More

Last week’s presidential debate at the Reagan Library elevated Social Security as a national issue that could reshape the 2012 campaign. Candidates spent the week… Read More

The Congressional Budget Office (CBO) just released its long-term outlook for the federal budget. As expected, we are going broke slightly faster than we were… Read More