Reid Throws Major Roadblock in Front of Tax Reform

Senate Majority Leader Harry Reid (D–NV) has just thrown a roadblock in front of tax reform that could stall the strong momentum that has been… Read More

Senate Majority Leader Harry Reid (D–NV) has just thrown a roadblock in front of tax reform that could stall the strong momentum that has been… Read More

A new study argues that the misnamed Marketplace Fairness Act (MFA), better known as the Internet sales tax, would be good for economic growth. But… Read More

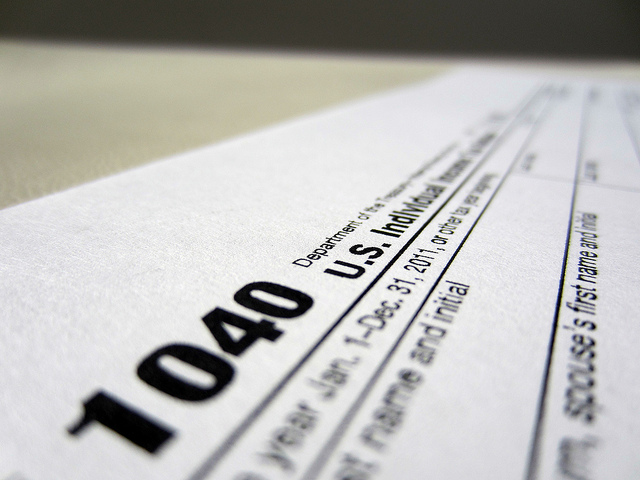

James Gandolfini died of a heart attack last month while traveling in Rome. The Sopranos star was estimated to be worth nearly $70 million, leaving… Read More

The momentum for tax reform continues to build. Adding to it is former Senator Phil Gramm (R–TX), who wrote an op-ed in The Wall Street… Read More

There is broad consensus that corporate tax reform is necessary to unleash business investment that the currently uncompetitive system prevents. Regrettably, some will use a… Read More

Chairman of the Senate Finance Committee Max Baucus (D–MT) and Ranking Member Senator Orrin Hatch (R–UT) recently proposed a “blank-slate” approach to tax reform. This… Read More

With talk heating up for Congress to create an Internet sales tax, Heritage pulled in leading telecommunication and tax experts yesterday for a Capitol Hill… Read More

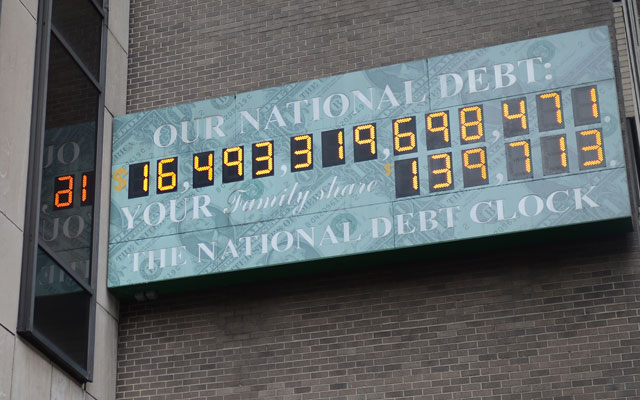

This week, the House Republican conference met to discuss what their priority will be in connection with any vote to increase the debt ceiling. This… Read More

The House Ways and Means Committee took another necessary step toward tax reform with a report requested from and issued through the Joint Committee on… Read More

News

Press reports link the coming debt limit debate with the building effort for tax reform. The debt limit and tax reform are both important, but… Read More