Morning Bell: 4 Reasons Warren Buffett Is Wrong on Tax Hikes

Let’s talk taxes. In a New York Times op-ed yesterday, famed investor and Berkshire Hathaway CEO Warren Buffett once again argued that the wealthy should… Read More

Let’s talk taxes. In a New York Times op-ed yesterday, famed investor and Berkshire Hathaway CEO Warren Buffett once again argued that the wealthy should… Read More

As we approach the “fiscal cliff,” there was little doubt that famed investor and self-appointed political sage Warren Buffett would pipe in at some point… Read More

Congressional lawmakers met last week to try to hammer out a deal to avert the fiscal cliff. Democrats insist on revenue increases as part of… Read More

On Friday, Representative Pete Sessions (R–TX) and House Speaker John Boehner (R–OH) ran afoul of Glenn Kessler’s “Fact Checker” blog regarding a study of President… Read More

According to Friday’s Washington Post, the Administration is considering a new, short-term tax cut. Should conservatives cheer? As a matter of principle, there are at… Read More

In the recent presidential debate, President Obama said that only 3 percent of small businesses would pay higher rates under his plan to increase the… Read More

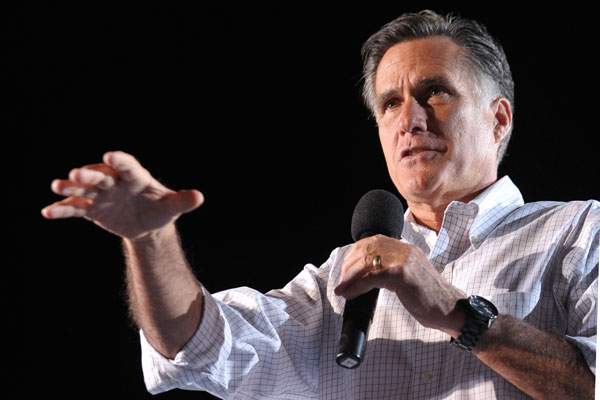

The Tax Policy Center (TPC) made headlines with its analysis of Governor Mitt Romney’s tax reform plan. The authors of the TPC report found, incorrectly… Read More

The Congressional Research Service (CRS) set out to make a convincing case that lower income tax rates do not strengthen the economy. It failed, but… Read More

How high is the marginal tax rate on each additional dollar the average American earns? In other words, if you got a raise of one… Read More

The Obama White House says it hates tax “loopholes,” and the American people abhor them with good reason. They’re the ultimate in unfairness, allowing those… Read More