Morning Bell: 3 Simple Solutions for Fixing Social Security

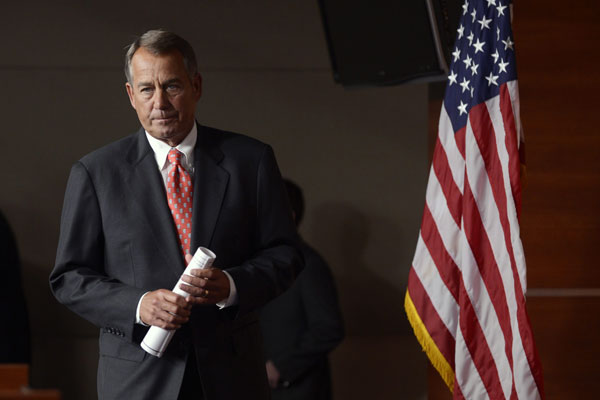

Later today the Republican-led House of Representatives will vote on “Plan B,” the latest unsatisfactory proposal put forward by Speaker John Boehner (R-OH) to avoid… Read More

Later today the Republican-led House of Representatives will vote on “Plan B,” the latest unsatisfactory proposal put forward by Speaker John Boehner (R-OH) to avoid… Read More

House Speaker John Boehner (R-OH) and Republican leaders have done it once again. Their latest fiscal cliff proposal capitulates on core conservative principles, yielding woefully… Read More

Kicking the can is the least repugnant remaining resolution to the fiscal cliff. The only alternatives appear to be the Republicans’ unconditional surrender on income… Read More

News

The latest fiscal cliff proposal by Speaker of the House John Boehner (R–OH) is infuriatingly frustrating to conservatives, again. In exchange for $1 trillion in… Read More

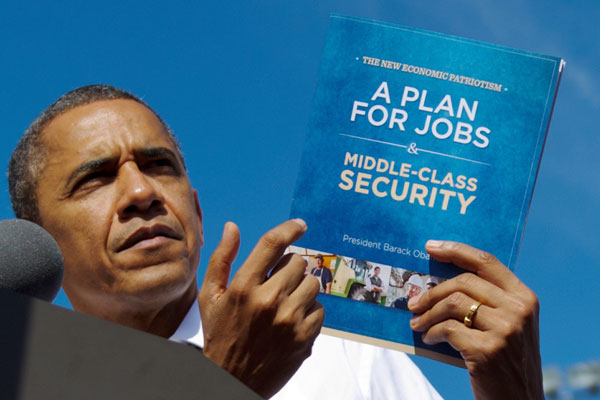

The one glaring omission in President Obama’s fiscal cliff demands for higher rates on top earners is that he’s already raised their taxes. That’s right!… Read More

In the midst of President Obama’s push to hike taxes on the most successful job-creating Americans, the President proposed a new “stimulus” of $25 billion… Read More

When President Obama put forth his first offer on the fiscal cliff, House Speaker John Boehner (R-OH) said, “You can’t be serious.” We could say… Read More

Even with the President’s desired tax hikes, publicly held debt would rise by $7.7 trillion in 10 years under the President’s budget. That’s right: Our… Read More

Health CareNews

As the fiscal cliff approaches, Congress and President Obama continue to debate tax increases, even though spending is the problem. Investor Warren Buffett recently opined… Read More

The fiscal cliff debate has centered on talk of raising taxes on high-income Americans. The silence on spending cuts has been deafening. On Monday, as… Read More