EconomyAnalysis

A Dynamic Leap Forward on Tax Policy

On May 21, Senator Rob Portman (R–OH) introduced an important piece of legislation, the Accurate Budgeting Act (S. 2371). It would require the Joint Committee… Read More

EconomyAnalysis

On May 21, Senator Rob Portman (R–OH) introduced an important piece of legislation, the Accurate Budgeting Act (S. 2371). It would require the Joint Committee… Read More

Herman Cain, who ran for president on the 9-9-9 tax plan, challenged Republican leaders in the House of Representatives to pass a tax reform bill… Read More

Chairman of the Senate Finance Committee Max Baucus (D–MT) released a draft bill to reform the way the tax code treats energy. This latest draft… Read More

The Joint Committee on Taxation (JCT) finally updated the antiquated way it analyzes business taxes. The update is an important and long-overdue step that will… Read More

The momentum for tax reform continues to build. Adding to it is former Senator Phil Gramm (R–TX), who wrote an op-ed in The Wall Street… Read More

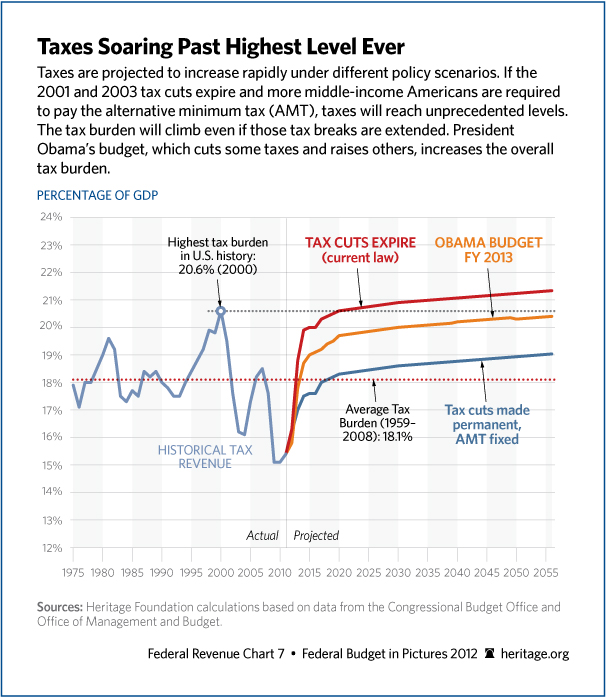

UPDATE: The official total tax increase in President Obama’s budget is now available in the Treasury Department’s “Green Book.” Treasury scores the total net tax… Read More

It has been nearly four years since the last time the Senate passed a budget. In that time, it hasn’t as much as proposed a… Read More

Representative Mike Pompeo (R–KS) hopes his new bill calling for the repeal of all energy tax credits on both conventional and renewable energy sources will… Read More

On January 1, 2013 nearly $500 billion in tax hikes will go into effect. In other words, “Taxmageddon.” Separating truth from fiction in politics, however,… Read More

Washington politicians talk a good game when it comes to job creation. But when it comes to actually doing something, they’ve been unable to provide… Read More