“I Don’t Know How President Obama Thinks That He’s Helping Us”

On Super Bowl Sunday, Bill O’Reilly asked President Obama what many Americans are probably wondering. “Was it the biggest mistake of your presidency to tell… Read More

On Super Bowl Sunday, Bill O’Reilly asked President Obama what many Americans are probably wondering. “Was it the biggest mistake of your presidency to tell… Read More

This year, The Foundry produced videos on a wide variety of topics and issues. We also had a lot of fun with them. Here are… Read More

Did you know there are 34 million different ways to make a Domino’s pizza? Mary Lynne Carraway can’t fit that on a menu board. But… Read More

The Securities and Exchange Commission (SEC) has proposed a rule that would impede capital formation, job creation, innovation, productivity improvement, and economic growth by making… Read More

Steven Herman, vice president of Paul’s Supermarket, and Stephen Bienko, owner of College Hunks Hauling Junk and Moving, want to take care of their employees…. Read More

The news media, the President, and Congress should be cautious in trotting out “victims” of the government shutdown. As national media continue the hype, the… Read More

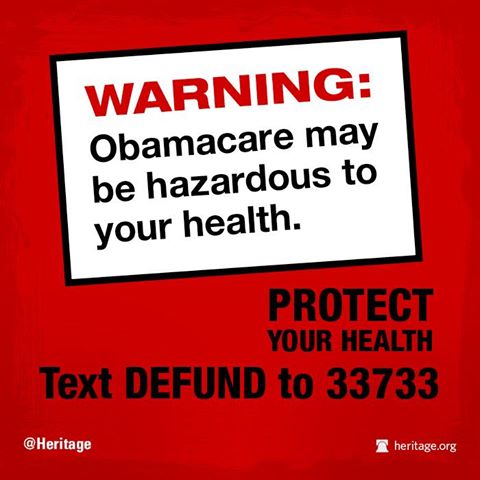

Obamacare opens today. What does that mean to you? Since Heritage launched our billboard in Times Square promoting the message to defund Obamacare, the response… Read More

Trader Joe’s grocery store is known for its affordable prices, unique food, and friendly staff — a grocery experience. But thanks to changes in employee health… Read More

SocietyNews

Threats and violent protests forced Sweet Cakes by Melissa, a small bakery located in Gresham, Oregon, to close its doors this weekend. In February, a… Read More

Health CareNews

Obamacare is not only hurting small businesses and economic growth. It might also give nearly a million low-income individuals a reason to leave work for… Read More