EconomyCommentary

Time to End the Fed and Its Mismanagement of Our Economy

Every major economic downturn of the last 110 years bears the mark of the Federal Reserve. In fact, as long as the Fed has been around, it has… Read More

EconomyCommentary

Every major economic downturn of the last 110 years bears the mark of the Federal Reserve. In fact, as long as the Fed has been around, it has… Read More

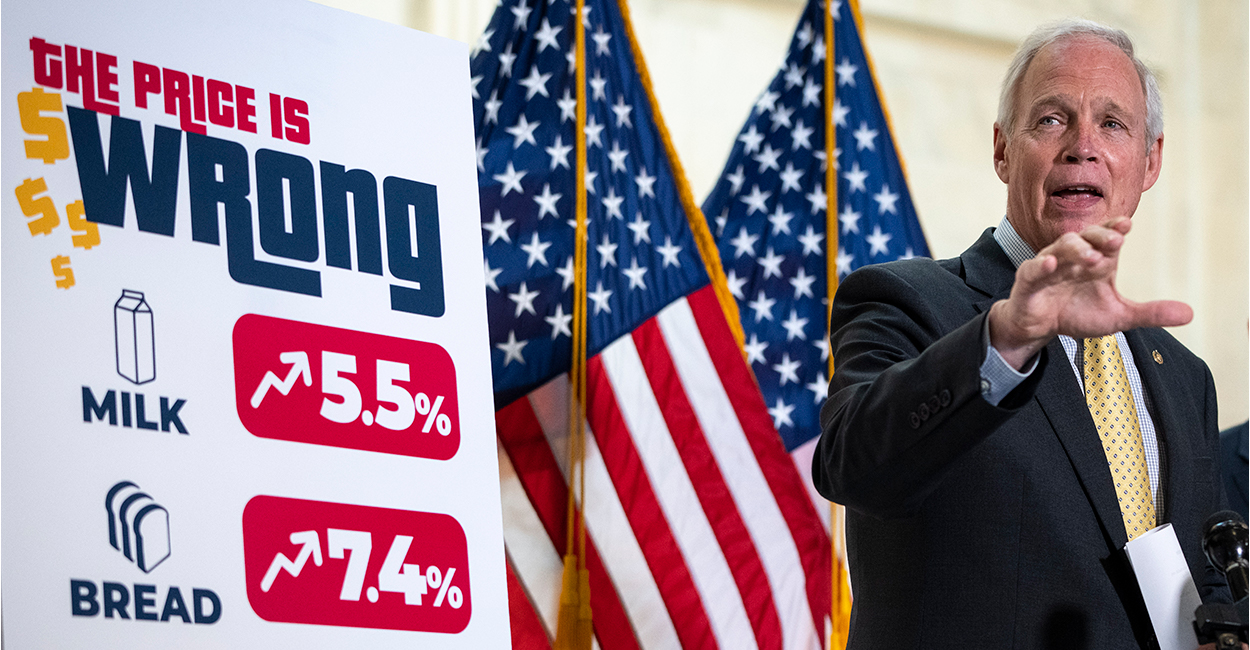

Economy Analysis

Americans have felt the effects of ballooning inflation as a direct result of government-mandated shutdowns of the economy. Prices on essential goods, including food and… Read More

EconomyCommentary

Inflation has been accelerating this year, and it isn’t hard to see why. Government spending has been so overwhelming that even former U.S. Treasury Secretary… Read More

EconomyCommentary

El Salvador passed a new law last month that makes bitcoin national legal tender alongside the U.S. dollar. This means Salvadorans can pay their taxes in bitcoin and use it for any debt or purchase. While this is the first time… Read More

EconomyNews

The Federal Reserve Bank, which is charged with setting monetary policy, appears to be going woke, Sen. Pat Toomey, R-Pa., warns. Toomey cited the focus… Read More

EconomyCommentary

As the worst and most devastating initial economic impact of the global pandemic begins to fade, nations around the world face a number of challenges… Read More

EconomyNews

Rep. French Hill, R-Ark., recently wrote an op-ed for The Wall Street Journal on House Democrats’ efforts to require the International Monetary Fund to issue… Read More

InternationalCommentary

Yoshihide Suga, the chief Cabinet secretary und former Japanese Prime Minister Shinzo Abe, was recently elected president of the Liberal Democratic Party in Japan and has… Read More

EconomyCommentary

Millions of Americans live in fear of another financial crisis, so they are willing to go along with extensive regulation of the financial sector. Unfortunately,… Read More

EconomyCommentary

The major credit rating agency Fitch Ratings announced July 31 that it was downgrading the U.S. federal debt outlook from “stable” to “negative.” This is… Read More