Economy Commentary

Yikes! Perilous Economy for First-Time Homebuyers

Buying a home is a cornerstone of the American dream, a dream that is further out of reach today for many Americans. According to the… Read More

Economy Commentary

Buying a home is a cornerstone of the American dream, a dream that is further out of reach today for many Americans. According to the… Read More

EconomyCommentary

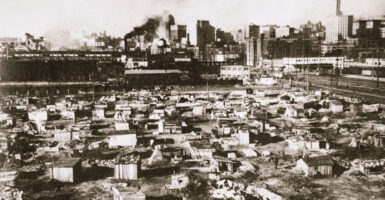

When people couldn’t afford housing during the Great Depression, they built shantytowns from scrap construction supplies and named them “Hoovervilles,” after President Herbert Hoover. Today,… Read More

SocietyNews

A plethora of federal agencies have spent well over $200 million attempting to alleviate homelessness in Washington state over the past 17 years, only for… Read More

EconomyNews

The housing market is not immune from inflationary woes as buyers’ purchasing power has significantly diminished in four years. Homebuyers in 2024 need 80% more… Read More

EconomyCommentary

Business headlines say that inflation is down, yet countless Americans are struggling, particularly with finding somewhere affordable to live. How do we reconcile these seemingly… Read More

SocietyNews

San Francisco wants federal taxpayers to help cover the more than $423 million it spent housing approximately 5,000 homeless people in hotels and other “non-congregate”… Read More

EconomyNews

Over the past three years, rent costs have risen dramatically for Americans as inflation and housing constraints push expenses up, according to data from Harvard’s… Read More

PoliticsNews

The federal government shouldn’t be permitted to use taxpayer funds to house illegal aliens on federal government land, under a bill passed by the House… Read More

EconomyCommentary

In boasting about “Bidenomics” two weeks ago in Milwaukee, President Joe Biden declared that his policies are “restoring the American dream.” Then he went into… Read More

EconomyCommentary

All around the nation can be found the detritus of “Bidenomics,” especially in America’s broken housing market. Countless families are struggling just to find somewhere… Read More