EducationNews

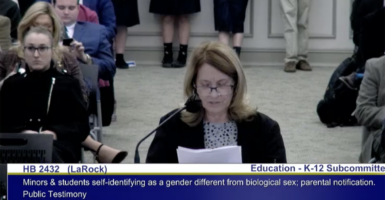

Missouri Schools Took Kids to a Drag Show Without Informing Parents. AG Bailey Is Working to Prevent It From Happening Again.

FIRST ON THE DAILY SIGNAL—Missouri’s attorney general sent a letter to the state’s association of school boards, urging it to adopt a resolution mandating that… Read More