EconomyCommentary

Making Sense of the Male-Female ‘Wage Gap’

What’s behind the wage gap between men and women? It has narrowed recently. In 2023, women’s median weekly wages of $1,005 equaled 84% of men’s… Read More

EconomyCommentary

What’s behind the wage gap between men and women? It has narrowed recently. In 2023, women’s median weekly wages of $1,005 equaled 84% of men’s… Read More

EconomyCommentary

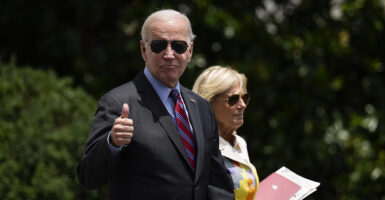

President Joe Biden’s latest budget proposes the federal government spend trillions more than it will take in, increasing the already unsustainable federal debt by $17… Read More

LawCommentary

A federal district court announced that it will vacate the so-called joint employer rule that threatened to upend the franchise business model and to impose massive… Read More

EconomyCommentary

Advocates of command economies argue that government regulation of wages, prices, and production will lead to a more equitable allocation of income and wealth. But… Read More

EconomyCommentary

The federal government has more than 90 welfare and workforce programs spread across dozens of federal agencies, with funding flowing to thousands of state and local… Read More

EconomyCommentary

Airline prices—which are already 22% higher than they were two years ago—could get a whole lot more expensive and many airport workers could lose their… Read More

EconomyCommentary

Whether working full time for themselves or part time as contractors, picking up occasional gig work or having a side hustle, an estimated 64 million… Read More

EconomyCommentary

The percentage of workers who belong to unions in the U.S. notched down to a record-low 10.0% in 2023, from 10.1% in 2022. The peak… Read More

EconomyCommentary

Some 99% of American companies are small businesses, and 100% of businesses started out small, but a recently finalized rule from the Biden administration’s Labor… Read More

EconomyCommentary

My foray into the workforce was a minimum-wage job making pizzas and washing dishes at Pizza Hut. The money I earned supported my spending as… Read More