The Obama Tax Plan: Undercutting Economic Growth

The President and his advocates in Congress argue that raising taxes on all taxpayers would damage the economy but that raising taxes on only “high-income”… Read More

The President and his advocates in Congress argue that raising taxes on all taxpayers would damage the economy but that raising taxes on only “high-income”… Read More

President Obama has made raising taxes on “the rich” a central plank of his re-election campaign. Yet even many Democrats are questioning the wisdom of… Read More

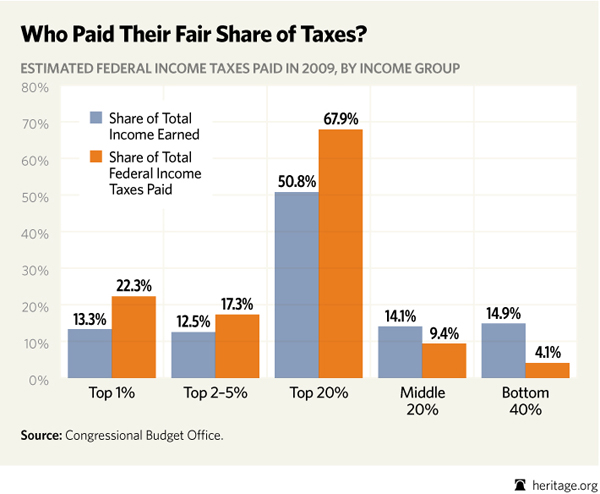

The Congressional Budget Office (CBO) just released its latest estimates on the share of taxes paid by income level, giving voters a way to check… Read More

There are many reasons to be against the Obama tax hikes, especially as the economy struggles to recover. However, even putting aside economic growth considerations,… Read More

Raising taxes on successful businesses is one thing we cannot afford to do. Large, successful businesses that create jobs would be hit the hardest, but… Read More

Despite their key role in creating the housing crisis, Fannie Mae and Freddie Mac are not being reformed, and will continue to cost the American… Read More

In the battle over the extension of the 2001/2003 tax cuts, a lot of myths about the tax cuts are being perpetuated. One of the… Read More

The White House Council of Economic Advisers (CEA) has released a projection of jobs created by the economic stimulus bill. However, the method they used… Read More

A year ago, President Obama warned the American people that the financial crisis was dire and required a whole new approach to government spending. Obama… Read More

It is a well known economic policy rule that if you want less of something you tax it, and if you want more of something… Read More