Congressional Budget Office Shows Senate Bill Is $600 Billion Tax Hike

The Congressional Budget Office (CBO) just now released its score of the bill the Senate passed early this morning while everyone was celebrating the beginning of… Read More

The Congressional Budget Office (CBO) just now released its score of the bill the Senate passed early this morning while everyone was celebrating the beginning of… Read More

The more time passes, the more we get to see in real life the consequences of Obamacare. We warned back when it passed that the… Read More

The one glaring omission in President Obama’s fiscal cliff demands for higher rates on top earners is that he’s already raised their taxes. That’s right!… Read More

As we approach the “fiscal cliff,” there was little doubt that famed investor and self-appointed political sage Warren Buffett would pipe in at some point… Read More

Taxes and entitlements were two important domestic policy topics discussed during the debate between Vice President Joe Biden and Representative Paul Ryan. Among the many… Read More

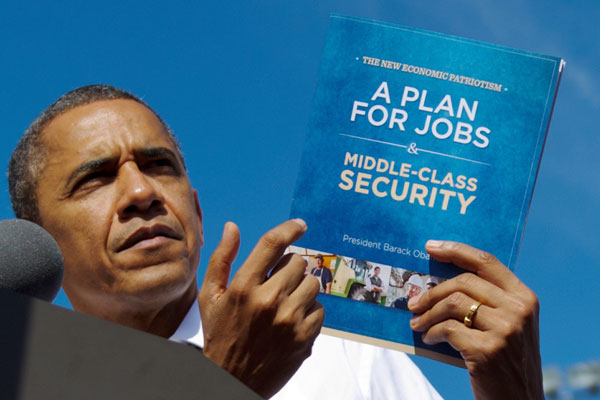

In the recent presidential debate, President Obama said that only 3 percent of small businesses would pay higher rates under his plan to increase the… Read More

The Congressional Research Service (CRS) released a report that should be a cause for concern to all who believe in limited government. In it, CRS… Read More

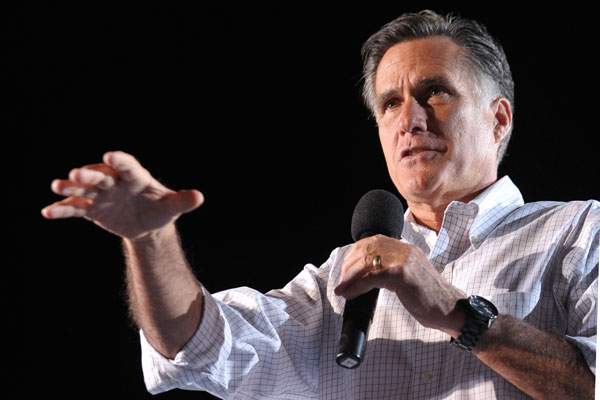

The debate about former Governor Mitt Romney’s (R-MA) tax plan has reached a fevered pitch. In fact, The Washington Post published two articles (here and… Read More

The Tax Policy Center (TPC) made headlines with its analysis of Governor Mitt Romney’s tax reform plan. The authors of the TPC report found, incorrectly… Read More

The Congressional Research Service (CRS) set out to make a convincing case that lower income tax rates do not strengthen the economy. It failed, but… Read More