We’re Losing Companies to Europe. Here’s Why.

I hate to say I told you so, but . . . A few months ago I warned that if Congress didn’t lower corporate taxes, U.S…. Read More

I hate to say I told you so, but . . . A few months ago I warned that if Congress didn’t lower corporate taxes, U.S…. Read More

The Bureau of Economic Analysis released its first report for GDP growth in the first quarter of 2014 today. It showed the economy grew at… Read More

This month marks the fifth anniversary of the Chrysler bankruptcy. President Obama will doubtless mark the occasion by talking about how his intervention saved the… Read More

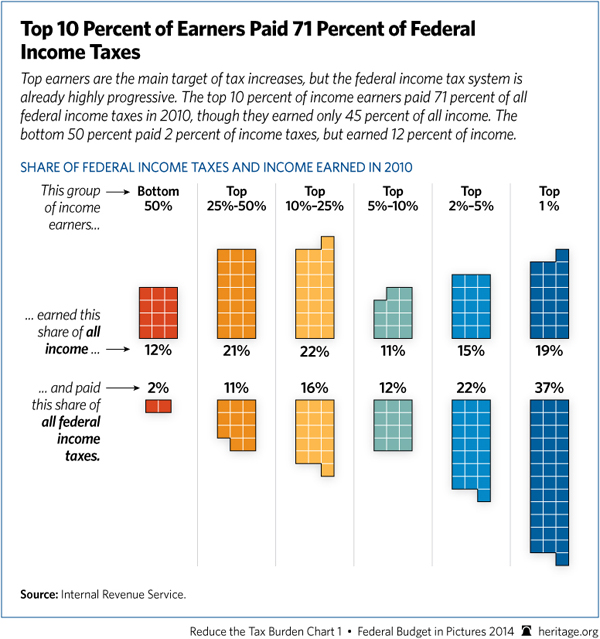

Matt Yglesias, now with Vox, finds this chart of ours misleading: He admits that the data is correct and that what it shows—that the federal… Read More

In today’s Wall Street Journal, the estimable Chris Chocola, former congressman from Indiana and current president of the Club for Growth, writes that Congress should… Read More

There they go again. The Congressional Budget Office (CBO) just released yet another report on the beneficial impacts on the economy of President Obama’s 2009… Read More

Over at Real Clear Policy, Robert VerBruggen asks some thoughtful questions about my recent paper “The Proper Tax Treatment of Interest.” Below are my brief… Read More

Five years later, it is obvious that President Obama’s stimulus was a failure. This week marks the fifth anniversary of Obama’s 2009 stimulus plan, a… Read More

The Bureau of Economic Analysis (BEA) will soon release its first estimate for how fast the economy grew in the fourth quarter of 2013 and… Read More

It’s about time for us to uncover our eyes and take a hard look at what 2013 did to our finances. Did you feel the… Read More