The Millionaire Surtax: Back from the Dead?

The “millionaire surtax” is the Michael Meyers of bad tax policy. Like the villain in the Halloween movie franchise, it keeps rising from the dead…. Read More

The “millionaire surtax” is the Michael Meyers of bad tax policy. Like the villain in the Halloween movie franchise, it keeps rising from the dead…. Read More

In a recent article titled “Hill Weighs Tax Trade-offs,” Politico reports that Congress is considering lowering the corporate tax rate and replacing the lost revenue… Read More

One reason economists sometimes compare themselves to astrologers is that their forecasts are often equally accurate. But when it comes to analyzing government policy, economists… Read More

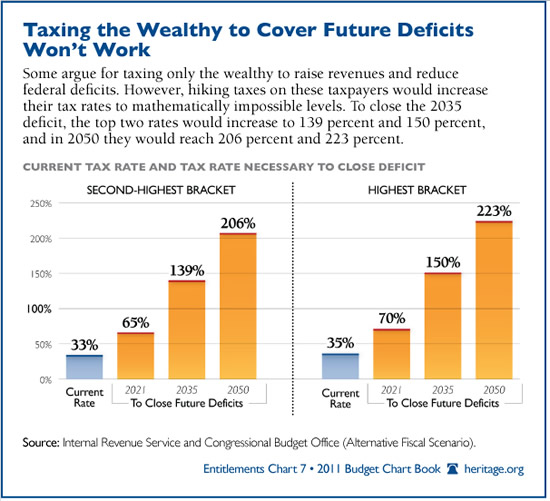

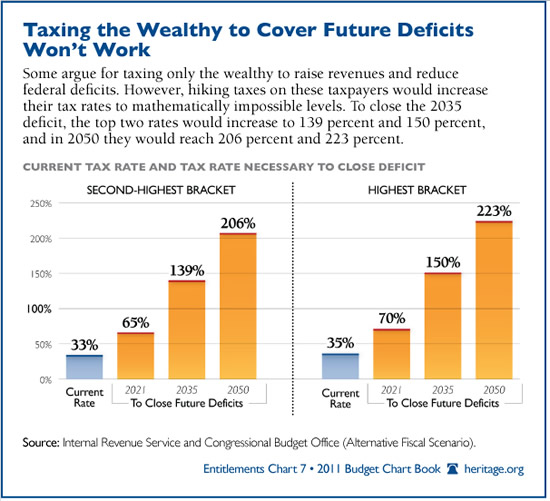

President Obama is insistent that taxes must go up to close the deficit. He says it’s just common sense that taxes must go up, because… Read More

The Congressional Budget Office (CBO) released its outlook for the federal budget last week. According to the CBO’s “Alternative Fiscal Scenario,” tax receipts will match… Read More

On December 31, a set of approximately 50 tax-reducing provisions commonly referred to as the “tax extenders” expired. These provisions, which apply to both individuals… Read More

Senate Majority leader Harry Reid (D–NV) drifted off to fairy-tale world this week and dreamed up some statistics as he did. On the floor of… Read More

Tax hikes were the focal point of the contentious, failed supercommittee negotiations designed to reduce the national debt by at least $1.2 trillion. Democrats wanted… Read More

EconomyNews

The Republican members of the Senate Finance Committee recently submitted their recommendations for tax reform to the deficit reduction super committee. Their recommendations lay out… Read More

President Obama is fond of saying he hasn’t raised anyone’s taxes. How soon he forgets the $500 billion tax hike in his health care law…. Read More