Student Loan Savings Tiny Compared to Taxmageddon Tax Increase

President Obama’s proposal to keep interest rates on one type of student loans below market level obscures the fact that, if Taxmageddon strikes, the tax… Read More

President Obama’s proposal to keep interest rates on one type of student loans below market level obscures the fact that, if Taxmageddon strikes, the tax… Read More

Former Governor Tim Pawlenty (R–MN), national co-chair of the Romney for President campaign, appeared on CNBC yesterday and chastised President Obama for failing to lead… Read More

There he goes again. It seems that President Obama just can’t help himself. He keeps pushing Congress to pass policies it has rejected in the… Read More

A few weeks ago, around Tax Day, Heritage started warning of Taxmageddon—a one-year, $494 billion tax hike that slams the economy on January 1, 2013,… Read More

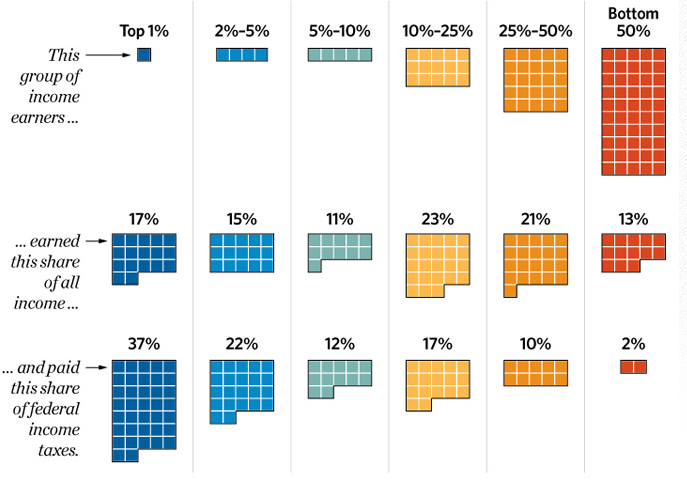

In The Wall Street Journal on Tuesday, Peter Diamond and Emmanuel Saez present a rambling defense of higher taxes on the rich to fund an… Read More

In a bit of scheduling serendipity, Tax Freedom Day—the day when Americans finally earn enough income to pay off the bill for all federal, state,… Read More

What do you do when you’re losing a debate? Change the subject. That’s really all you need to know to understand President Obama’s resuscitation of… Read More

This April Fool’s Day, the joke is on all of us. That’s because as of April 1, the U.S. now has the highest corporate tax… Read More

Rule #1 of tax reform: Tax reform does not raise taxes. The budget resolution sponsored by Representatives Jim Cooper (D–TN) and Steve LaTourette (R–OH) breaks… Read More

President Obama’s infamous “Buffett Rule,” which would set a 30 percent minimum effective tax rate for families and businesses with incomes greater than $1 million,… Read More