EconomyCommentary

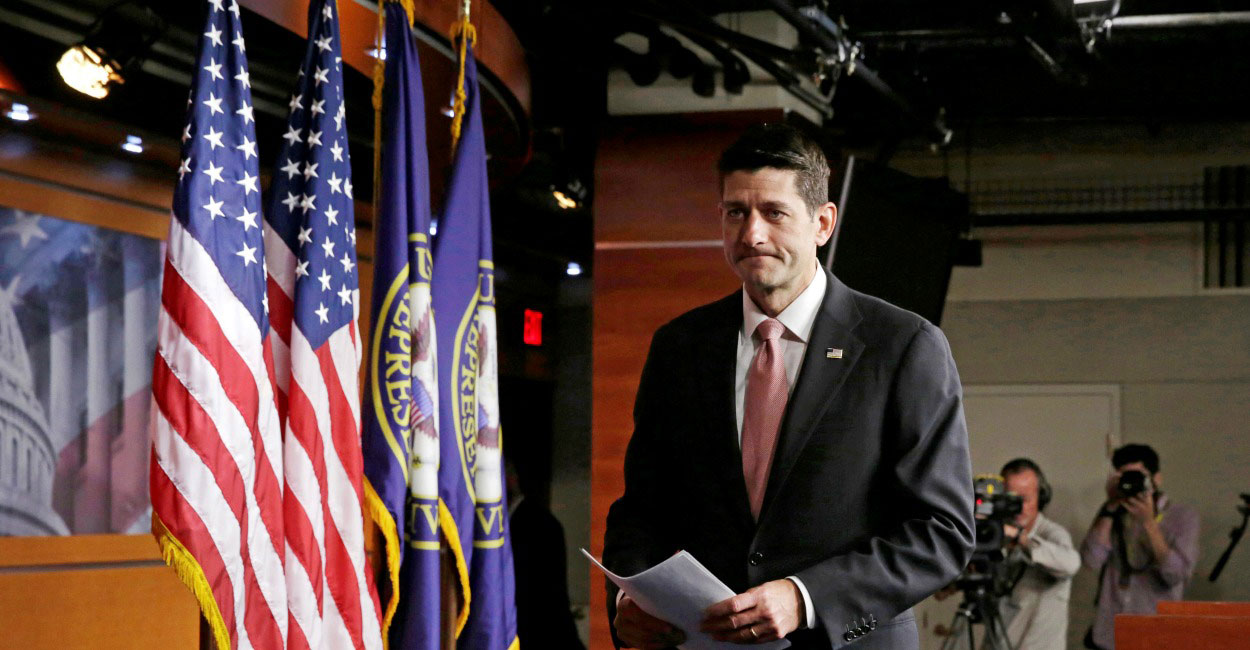

The State of Tax Reform in 2016

Tax reform remains a central issue in Washington because of its overwhelming necessity. Tax reform is badly needed to revive the slow-growing economy and increase… Read More

EconomyCommentary

Tax reform remains a central issue in Washington because of its overwhelming necessity. Tax reform is badly needed to revive the slow-growing economy and increase… Read More

EconomyCommentary

House Judiciary Chairman Bob Goodlatte, R-Va., has reignited the debate over state taxes on out-of-state (mostly internet-based) sales in releasing draft legislation to allow such… Read More

EconomyCommentary

President Barack Obama isn’t afraid to enact his agenda over the will of Congress. At this late stage in his presidency, he’s still overreaching his… Read More

EconomyAnalysis

House Republicans released a blueprint for tax reform on Friday. If Congress follows the architecture the blueprint lays out, it will create a strongly pro-growth tax… Read More

EconomyAnalysis

Sen. Ron Wyden, D-Ore., has released a plan to update the way businesses deduct the cost of capital expenses. Wyden is right to focus on… Read More

EconomyCommentary

The U.S. tax system makes it extremely difficult for international businesses to compete in the global market. A prominent and recent example of the lengths… Read More

EconomyCommentary

Congress appears to be looking at a scaled back two-year extension of all the policies in the tax extenders, rather than the bigger deal that… Read More

EconomyCommentary

The annual ritual is upon us. Congress is busy at work crafting a bill to extend the approximately 50 tax-reducing policies that expire each year,… Read More

EconomyCommentary

When a family want to spend more money on a house, a car, education, or anything else they want to buy, the first question they… Read More

EconomyCommentary

Recently, I had the honor to testify before the Ways and Means Subcommittee on Select Revenue Measures about using changes to repatriation policy as a… Read More