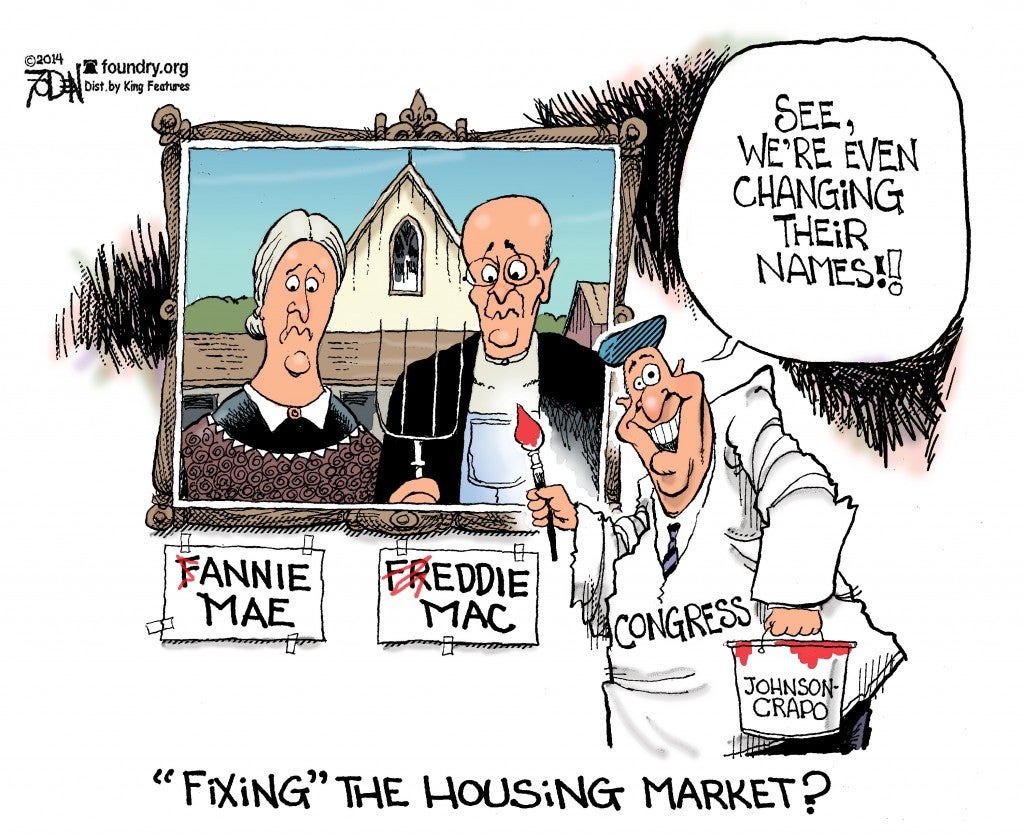

In 2009, Congress used nearly $200 billion to bail out the housing finance companies Fannie Mae and Freddie Mac. These companies are still operating under the direct control of the federal government, and taxpayers are underwriting an even larger share of mortgages now than in 2008. Even worse, the U.S. Senate is poised give us Fannie–Freddie 2.0 in the new housing reform bill that Senators Tim Johnson (D., S.D.) and Mike Crapo (R., Idaho) have released.

The Johnson-Crapo bill would wind down the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, but would also replace them with a new government agency that expands the federal government’s grip on the housing market. If the Johnson-Crapo housing bill is adopted, the federal government will have effectively taken over the U.S. mortgage market.