Today the White House released President Barack Obama’s budget for fiscal year 2015. Assembled below is commentary on Obama’s budget written by The Heritage Foundation’s research experts. Keep watching this post for all the latest updates.

Obama’s 2015 Budget: A Vision That Big and Expensive Government Is Necessary for American Success

“Change won’t come from the top, I would say. Change will come from a mobilized grass roots.” This was President Obama in his memoir, Dreams from My Father. And yet Obama’s 2015 budget released today shows a vision where federal government involvement is at the core of American success.

Obama’s budget would funnel more taxpayer dollars towards inappropriate federal spending that’s fraught with special interest carve-outs: universal pre-school programs; a Washington-centric approach to local transportation and infrastructure needs; and manufacturing innovation centers and energy efficiency subsidies to direct “innovation” in America.

With $55 billion in reported additional spending on expensive big government programs, Obama encourages Congress to yet again violate the discretionary spending caps. Although Obama claims that his budget doesn’t violate the spending caps, this is largely an exercise in rhetoric: It depends on the definition of what a spending “cap” is. Does Obama’s budget propose to spend more than the current Budget Control Act caps allow? If the answer is yes, then clearly the President’s budget would violate the caps.

While Obama focuses on expanding inappropriate and wasteful domestic federal spending, he is falling short as commander-in-chief of the Armed Forces. As Michaela Dodge, Heritage Defense and Strategic Policy analyst explains:

The President’s defense budget yet again fails to adequately prepare our men and women in uniform to effectively fight current and future wars. The President chose to ignore structural reforms the Pentagon needs, including military healthcare, retirement, and acquisition system reforms. Thus, the President abrogated his responsibility to provide for the common defense and be a good steward of taxpayer’s dollars.

Obama’s budget would have the following effects in numbers:

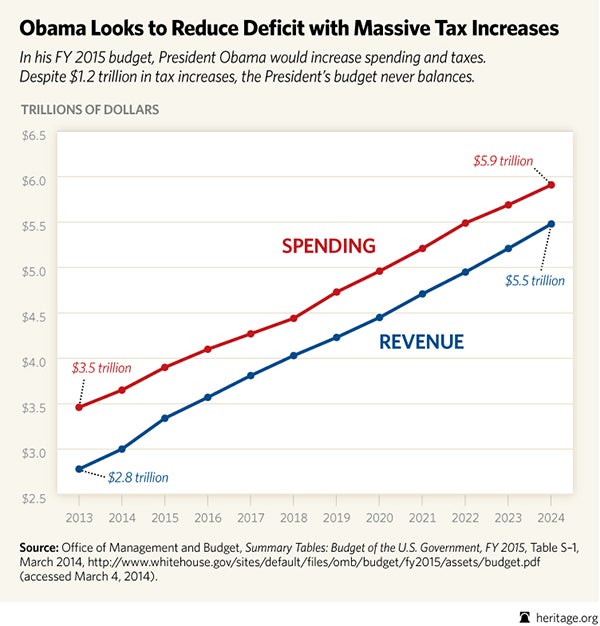

- Spending would go from $3.5 trillion in 2013 to nearly $6 trillion in 2024.

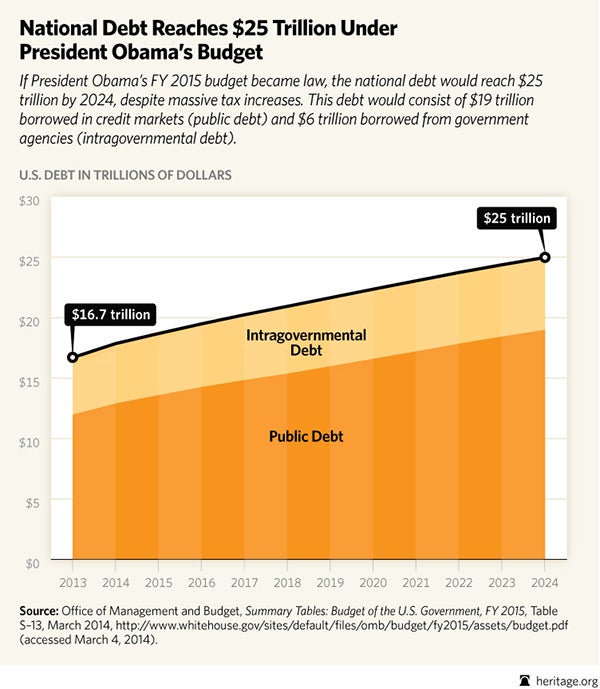

- Debt borrowed in credit markets (public debt) would grow from $12 trillion in 2013 to $19 trillion in 2024.

- The national debt, including debt owed to government agencies would grow from $17.3 trillion today to $25 trillion in 2024.

- Per a cursory reading, the President’s budget includes about $1 trillion in new spending and about $1.2 trillion in tax increases.

- Obama claims nearly $2.2 trillion in deficit reduction over the 10 year budget window, but this figure includes massive tax increases and such well-known budget gimmicks as $700 billion in cancelled war-related spending (OCO).

Heritage Foundation President Jim DeMint’s book, Falling in Love with America Again, came out today — and it stands in stark contrast to Obama’s vision for America. In it, DeMint tells stories of individuals across the country who are making America great by building their communities from the bottom up.

— Romina Boccia

Excluding Student Loan Forgiveness from Taxation Gives More Free Rein to Universities to Hike Tuition

The President’s budget proposes excluding student loan forgiveness from being taxed. Student loan forgiveness is income and should be treated as such. Student loan forgiveness itself is bad policy, and taxation exclusion continues a worrisome trend of ever-increasing subsidies for higher education, which do nothing to put pressure on universities to lower costs.

If the President really wanted to ease the burden of college costs, he would embrace policies to reform accreditation, such as decoupling federal financing from accreditation to enable states to have more nimble credentialing systems that actually reflect student skills that provide value to employers. Sen. Mike Lee has just put forward such a proposal to empower states to allow any entity to credential courses. Credentialing courses and acquired skills, not institutions, will be a far better reflection of the competencies valued by employers, will help bring down college costs, create a more flexible higher-ed experience for students, and bring down the barriers to entry for innovative start-ups.

— Lindsey Burke

One Billion Dollar Climate Fund: Wasteful And Duplicative

The President’s budget calls for a $1 billion climate fund to collect data, help communities affected by extreme weather events, and invest in new technologies to better prepare the country for more climate extremes. The federal government already spends tens of billions of taxpayer dollars for climate research and “investing” in technologies where the private sector should be the sole driver of investment.

Before throwing another billion dollars at a non-problem, perhaps the administration should look at the data climatologists have already collected on climate change and extreme weather events. The available climate data simply do not indicate that we’ve been experiencing more frequent and volatile natural disasters. As global greenhouse gas emissions have increased, we haven’t seen more intense floods, droughts, hurricanes, and tornadoes. That said, preparedness for hurricanes and other natural disasters can be an effective use of resources, but it should be driven at the local, state, and regional levels. And if Obama is sincerely worried about our ability to prepare and respond to natural disasters, he should stop his job and economy-crushing climate regulations that will shrink our resources and diminish our ability to address real environmental problems – all for no meaningful climate impact.

— Nicolas Loris

Universal Preschool Will be Expensive, Ineffective, and Duplicative of Existing Options

President Obama proposes spending billions to create universal preschool for every four-year-old child in the country. But is it necessary?

The federal government already operates 45 early learning and child care programs along with five tax provisions that subsidize early education and care. Total federal spending on these exceeds $20 billion annually. Forty states and the District of Columbia provide subsidized preschool at the state level.

At current levels of spending by the federal government and states, and with the provision of private preschool and home-based care, “a large majority of families have already made their way to existing providers.” More than three-quarters of four-year-old children are already enrolled in some form of early education and care program.

Moreover, many parents choose not to send their children to preschool centers, electing instead to stay home with their children during their most formative years. Strong majorities of mothers indicate that they prefer to stay home when their children are young (up to age four); 80 percent of mothers who work part-time indicate that is the ideal scenario for them.

Demand for a new large-scale government preschool program is not evident. Proposals to expand government preschool would appear to be duplicative of existing efforts at best, or a new middle- and upper-income subsidy at a time when deficits are at an all-time high.

Plus, the verdict is still out on the relative efficacy of preschool. Whether it works “depends on how picky you are,” notes Brookings’ Russ Whitehurst. The Tennessee Voluntary State Pre-K Program, which has many of the attributes championed by the Obama administration as being “high quality” – it’s full-day, teachers are licensed, low child-teacher ratios, etc. – was found in August 2013 to be ineffective at improving child outcomes. Researchers at Vanderbilt University conducted a randomized control trial (a hallmark of scientific rigor) and found that children in the control group (the group not enrolled in the preschool program) performed better on cognitive tasks than children who went through the program.

In recent testimony before the House Education and the Workforce Committee, Whitehurst explains that “the group that experienced the Tennessee Voluntary State Pre-K Program performed less well on cognitive tasks at the end of first grade than the control group, even though three quarters of the children in the control group had no experience as four-year-olds in a center-based early childhood program of any sort. Similar results were obtained on measures of social/emotional skills.”

It’s not the first time government preschool has failed to deliver on proponents’ promises. The half-century-old federal Head Start program has failed enrollees for decades, producing little to no impact on children’s cognitive abilities, their parents’ parenting practices, their socio-emotional well-being, or their health.

— Lindsey Burke

On Transportation, Obama Budget Gets Both Policies and Funding Wrong

If history is any guide, President Obama’s fiscal year (FY) 2015 budget proposal will get little to no attention in Congress. That is a good thing, especially regarding his proposal for a “unified,” (mode-neutral) four-year transportation bill that would be paid for in part with revenue from corporate tax reform.

States do have transportation project priorities that will cost money. But under the Obama budget’s top-down approach, the states’ efforts to meet those priorities would be hampered. Obama gets both the transportation policies and funding source wrong—again.

First, the President proposes a $302 billion, four-year transportation bill—a 38 percent increase over current annual spending—to replace what is currently a highway bill funded by highway user fees: per gallon gasoline taxes and related taxes paid by the motorists, bus operators, and truckers who use the system. It would lump together the existing highway and bridge programs with transit systems and railways in a unified transportation bill to be funded with existing federal gas taxes and new corporate tax reform revenue.

As Heritage previously wrote, this plan is dangerous. It would double down on a Washington-centric approach to transportation and fling the door wide open to allowing special interests to lobby for diverting increasing shares of highway user fees to non-highway, non-bridge programs. Such diversions would come at the expense of needed congestion relief, capacity expansion, and road and bridge repair projects that would benefit the motorists contributing the user fees in the first place.

Second, Obama’s idea to pay for this transportation bill with new revenue resulting from corporate tax reform is flawed and irresponsible. Any such revenue should go toward lowering tax rates or other pro-growth tax policy improvements, not to pay for new spending elsewhere. Further, the states are stepping up, with over 20 states either implementing or considering plans to raise money to pay for their transportation projects. And interest on the part of the private sector to finance expensive projects is another piece of the funding pie—and the private sector can certainly be a bigger player if Washington would step out of the way.

There are other flaws in Obama’s transportation plan, but these two stand out. It’s high time that Obama refocus his efforts on reducing burdensome federal regulation in transportation and freeing the states to meet their transportation priorities. After all, they know them best.

— Emily Goff

More Federal Support for Common Core in Budget

While advocates, including the Obama administration, continue to claim that adoption of Common Core national standards and tests is voluntary, this year’s budget owns up to the fact that the White House has driven adoption of Common Core. The President’s budget notes that “Forty-six states are implementing rigorous college- and career-ready academic standards and nearly all will field test performance-based assessments tied to those standards this spring, a movement fueled by previous RTT [Race to the Top] grants.” (emphasis added)

The budget refers to the forty-six states that have adopted Common Core. The FY2015 budget makes no bones about the fact that the administration incentivized the adoption of these national standards through billions in prior federal grants, and aims to further incentivize adoption in the budget process.

Even though many of those forty-six states are having second thoughts about handing over control of the content taught in local schools to national organizations and Washington bureaucrats, the administration continues to use the federal Department of Education as a lever to cement their adoption.

— Lindsey Burke

TIGER Transportation Grant Programs Keeps on Roaring

The Transportation Investment Generating Economic Recovery (TIGER) grants are still here. This federal program has nothing to do with tigers but rather everything to do with Washington stimulus spending and a flawed, top-down approach to transportation and infrastructure.

President Obama’s fiscal year (FY) 2015 budget request calls for $1.25 billion in spending per year for the TIGER program, a competitive grant program that pays for road, rail, transit, and port projects that are supposedly in the “national interest.” His proposal would more than double the annual spending on this program, compared to the FY 2014 level of $600 million, which is already inflated by $125 million compared to the previous year.

Bottom line: it’s too much—in fact, any spending is too much—especially for a program that was started under the stimulus bill in the name of boosting the then anemic economy. President Reagan’s quip that “a government bureau is the nearest thing to eternal life we’ll ever see on this earth” applies to TIGER grants, because here we are, six rounds of TIGER funding later. And the President wants to make it a permanent program.

The first reason the TIGER program should be ended is that it is a federal program that uses federal taxpayer dollars to pay for purely local activities. It duplicates the efforts of state transportation and infrastructure agencies, adding to bureaucracy and wasting money in administrative overhead costs. And it forces states to pander to the project criteria set forth by Washington bureaucrats, which may not align with their priorities and project goals.

Further, the types of projects it funds are local in nature and would more appropriately be funded at the state and local level, where any benefits would be enjoyed. In FY 2013, for example, TIGER grant money was spent on projects such as a $16 million, 6-mile pedestrian mall in Fresno, CA; a $10.4 million “Complete Street Initiative” (a.k.a. non-auto friendly) project in Lee County, FL; and a $20 million trolley car in Kansas City, MO.

This isn’t to say these activities don’t lack value or aren’t priorities of states and communities, but they are not federal responsibilities or priorities.

Secondly, the TIGER program is based on the false notion that government spending boosts the economy. Americans saw what an abysmal failure that way of thinking was in the example of the stimulus program—employment levels and the health of the economy in the aggregate did not improve as was promised. What the President and his economic advisors are forgetting is that every dollar spent by Washington is one less dollar the private sector would likely spend more efficiently.

Mr. President, it’s time to finally end the TIGER grant program.

— Emily Goff

President’s Budget Abandons Social Security Reform

The President’s budget remains a disappointment to bipartisan advocates of entitlement reform. As signaled by the administration, the budget drops President Obama’s former proposal to enact chained CPI for cost-of-living adjustments (COLA) to Social Security benefits. Adopting chained CPI for COLAs would still allow for benefits to grow over time while tying them to a more accurate measurement of inflation. The measure would save Social Security $130 billion over ten years without cutting benefits and would continue to ensure payments are adjusted for price changes.

Abandoning this proposal typifies the fiscal irresponsibility of this administration. Social Security is already hemorrhaging billions of dollars and is on track to run a $322 billion deficit by 2032 if no reforms are made. While adopting chained CPI would not solve Social Security’s fiscal woes, it would be a good step towards preserving benefits for those that need them most in the future. If the President was sincere about “working in a bipartisan way to strengthen the program for future generations,” as he stated in his budget, he would have included a chained CPI proposal—and taken leadership in working towards comprehensive reform that would ensure the program’s future solvency.

— Michael Sargent

President Obama Pays for New Spending Initiatives with Inflated Economic Assumptions

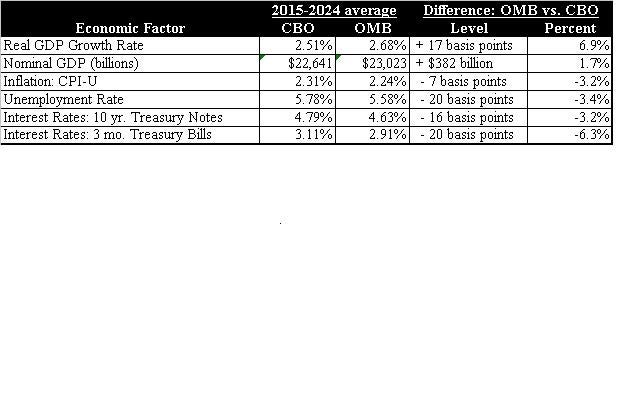

The President’s budget relies on rosier economic assumptions than the non-partisan Congressional Budget Office (CBO). These overly optimistic assumptions result in significantly lower deficits and debt than would exist if the President’s Office of Management and Budget (OMB) were to instead use CBO’s economic assumptions for their baseline projections. In other words, the President pays for some of his new spending initiatives through inflated economic assumptions.

For example, OMB assumes real GDP growth is 6.9 percent higher (or .17 percentage points), on average, over the 2015-2024 forecast than CBO. Similarly, OMB assumes that the unemployment rate is 3.4 percent lower ( .2 percentage points) than projected by CBO. Higher economic growth and lower unemployment translate into increased tax revenues and reduced spending.

OMB also assumes interest rates on U.S. Treasuries are lower by an average of 3.2 percent (16 basis points) for 10-year Treasuries, and by 6.3 percent for 3-month Treasuries. Among other things, lower interest rates translate into reduced spending through lower interest payments on the U.S. debt.

While it is true that changes in policies can affect economic growth, the provisions in the President’s budget would result in lower, rather than higher, economic growth. Increased taxes targeted at some of the most productive individuals and businesses would depress economic growth. Redistributing those higher taxes to government-run programs and initiatives, many of which are arguably inefficient and unsuccessful, would push economic growth even further below its potential.

— Rachel Greszler

Another Gargantuan Tax Hike

President Obama is at it again. His budget calls for at least $1.2 trillion in higher taxes, which is similar to budgets from previous years. It’s possible that figure will go higher because the President’s team is fond of burying large tax hikes in footnotes in the budget. It takes time to uncover all of them.

These tax hikes would drive tax revenues well above their historical average of 18 percent of GDP and well above revenue levels CBO anticipates on our current trajectory. In 2024 Obama would push tax receipts to 19.9 percent of GDP, just shy of the all-time high.

All this extra revenue would be used to grow the already bloated size of the federal government.

The biggest single tax hike (there are scores of them) is a cap of itemized deductions for high-earning families. In addition to being a step away from tax reform, it is also troubling policy because it would apply to municipal bond income, retirement savings, and health insurance.

The President brings back the Buffett Rule again. It is premised on the false notion that high-earners don’t pay their fair share. Implementing it would make the tax code an even bigger barrier to economic growth.

Not content with the increase of the death tax in last year’s fiscal cliff deal, Obama wants to raise it yet again. The right policy is to abolish it permanently because of deep harm it inflicts on family-run businesses and its negative impact on entrepreneurship.

A bank tax is again included on the long list of tax hikes, as is an increase of tobacco taxes, higher taxes for small business owners, higher unemployment insurance taxes, and higher taxes on carried interest.

Instead of raising taxes, it would be better for the country and the economy if Obama followed the lead of House Ways and Means Chairman Dave Camp (R-MI) and focused on reforming the tax code so it is less of an albatross around the neck of the economy.

— Curtis Dubay

Budget Squanders Money On Federal Job-Training Programs

In his FY 2015 budget request, President Obama released his vision of $11.8 billion for federal job-training programs: “The Budget’s approach to skills and training is guided by the principle that all federal investments should be designed to equip the Nation’s workers and job seekers with skills matching the needs of employers looking to hire them into good jobs.” However, the promise of federal job training programs has never lived up to the rhetoric of politicians.

In my book Do Federal Social Programs Work?, I present the evidence from every multi-site experimental evaluation of federal social programs, including various job-training programs, published since 1990. Based on these scientifically rigorous evaluations using the “gold standard” of random assignment, these studies consistently find failure. Federal training programs intended to boost the entrepreneurship and self-employment of the unemployed hasn’t worked. Further, federal job training programs targeting youth and young adults have been found to be extraordinarily ineffective. The simple fact is that when it comes to federal job training programs, there is a dearth of evidence suggesting that these programs work.

If Congress takes up the President’s plan, then it should insist that these programs undergo scientifically rigorous multi-site evaluations that use random assignment to ensure that taxpayers know whether their hard-earned money is being wasted or not.

— David Muhlhausen

New Race to the Top Equity and Opportunity Grant

The President’s budget includes a new $300 million Race to the Top Equity and Opportunity grant program “centered on increasing the academic performance of high-need students and closing the achievement gap.” The grants will focus on the nation’s highest poverty schools, and notes that “the problem of inequitable opportunities for students in the nation’s highest poverty schools denies those students the quality education needed to compete successfully in the global economy and imposes a substantial economic cost on the nation.”

Liberals tend to look at equitable opportunity as a matter of increased funding for the government’s choices, rather than freeing individuals up to make their own choices. If improved outcomes are the goal, opportunity through educational choice is a better bet. Throwing hundreds of millions in new federal funds to high poverty schools has shown little success in improving educational outcomes for low-income students. By contrast, studies have shown that educational choice in low-income communities is getting results. Unfortunately, federal agencies have, as of late, worked against the proliferation of opportunity in these exact districts.

The Department of Justice has tried repeatedly to shutter Louisiana’s scholarship program; more than 90 percent of the 5,000 vouchers awarded through the scholarship program went to minority children during the 2012–2013 school. Low-income and minority students who benefit the most from school choice are being particularly hard hit by the DOJ’s misguided efforts. Similar tactics have been used by the administration against Wisconsin’s oldest-in-the-nation school choice program, and the administration repeatedly attempts to zero-out funding for the highly successful D.C. Opportunity Scholarship Program.

The White House has said nothing about newly elected New York City Mayor Bill de Blasio’s moves against charter schools. De Blasio is blocking several charter schools – run by the Success Academy charter school network – from opening or expanding, rolling back an offer made to the charter network by his predecessor, Mayor Michael Bloomberg, to co-locate in spaces not being fully used by the traditional public school system. As was noted in a profile of the charter schools’ founder Eva Moskowitz in the Wall Street Journal last week, the stakes are high: “The 6,700 students at her 22 Success Academy Charter Schools are overwhelmingly from poor, minority families and scored in the top 1% in math and top 7% in English on the most recent state test…”

A true race to the top for opportunity would mean, at the very least, not hampering state and local school choice programs with federal threats and obfuscation. Allowing school choice to flourish unencumbered by the executive branch would go a lot farther in increasing education equity than $300 million in federal grant money ever will.

— Lindsey Burke

The President’s Health Care Budget

Despite the current health care spending crisis, President Obama’s budget does little to reform the fiscally unsustainable Medicare and Medicaid programs and maintains the implementation of Obamacare—which has created two additional health care entitlements and adds almost $2 trillion in new entitlement spending by 2024.

Obamacare. The President’s budget requests full funding for the continued implementation of Obamacare yet does not ask Congress to make any legislative changes to the law — therefore, he’s asking American taxpayers to continue to fund an unaffordable, unworkable, and unfair law.

Medicaid. The President’s budget papers over the fiscal crisis at the state and federal level with policy changes that reinforce its structural deficiencies rather than making any meaningful reform to the program.

Medicare. Despite the magnitude of the financing challenges facing Medicare, the President’s budget fails to provide sufficient changes to stabilize or enhance the solvency of the program for future generations.

— Alyene Senger

The Budget And Crop Insurance

President Obama’s budget would cut $14 billion over 10 years from the most expensive farm program, crop insurance. Reining in the costs of the crop insurance program is very important. From 2000 to 2006, crop insurance costs averaged $3.1 billion per year. The price tag has now tripled to $9 billion dollars.

Taxpayers subsidize about 62 percent of the premium that a farmer pays for crop insurance. Without appropriate reform this excessive subsidy could hardly be called a “safety net” for many farmers who receive aid and instead amounts to a massive wealth transfer from taxpayers to farmers, often large agribusinesses. Modest reforms to the crop insurance program, such as reducing the total amount of the premium subsidy that farmers can receive, could save billions of dollars over a 10-year period.

However, Obama had a chance to address the crop insurance program in the farm bill that was just passed, yet he still signed the bill into law that actually increased crop insurance costs. This was after he had proposed cutting about $12 billion in crop insurance costs in his last budget. Listing proposed cuts to the crop insurance program doesn’t mean much unless the President takes action to try and make his crop insurance reforms a reality.

— Daren Bakst