The nation’s fiscal situation is much worse today than when President Obama first took office. Public debt borrowed in credit markets stands at 73.6 percent of gross domestic product (GDP), a level last seen after World War II. And yet, the news and many lawmakers will tout a very different story.

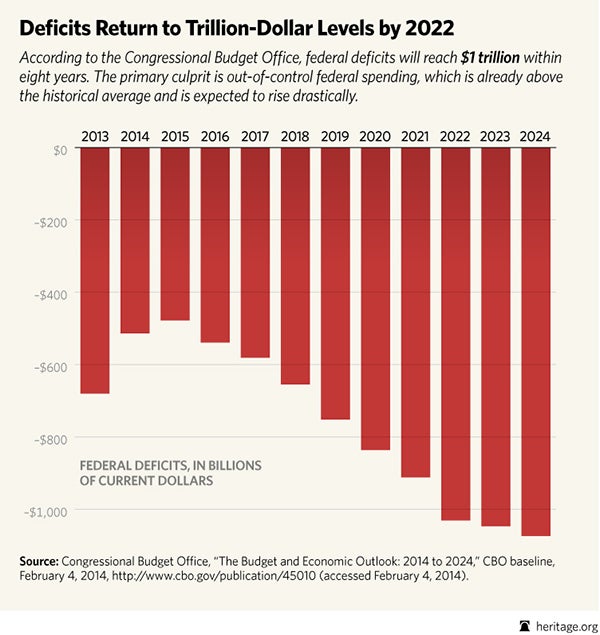

At $514 billion for 2014, the Congressional Budget Office (CBO) Budget and Economic Outlook released today projects a slight improvement in the deficit from the previous year. No doubt, this will reinforce Washington’s shoulder-shrugging attitude towards the nation’s worsening fiscal situation.

Public debt doubled since the Great Recession, as the deficit exceeded $1 trillion every year during President Obama’s entire first term. The deficit looks better only when compared to such excessively high deficit levels. Moreover, this year’s improvement is a misleading short-term phenomenon.

The nation’s spending trajectory will only get worse the longer it remains on its fiscal collision course. Spending on the major entitlements—Social Security, Medicare, Medicaid, and Obamacare—is set to explode over the next few decades. This CBO report offers merely a glimpse of the nation’s dire fiscal future, showing deficits rising back up to trillion dollar levels well before the end of the decade.

Growing spending, especially on entitlement programs, is solely responsible for soaring deficits in future years. The CBO projects that revenues will climb above their 40-year average, to 17.5 percent of GDP in 2014, reaching 18.2 percent by 2015 and 18.1 percent on average for the decade. But this assumes about a $900 billion tax increase under the CBO’s baseline projections from a number of tax provisions that are set to expire but that Congress has mostly extended every year. Without this tax increase, revenues would still exceed their average historical level of through 2024.

Instead, higher revenues continue to chase ever-higher spending. Assuming no “doc fix” in future years and that the Budget Control Act won’t be further weakened spending would still grow from $3 trillion (20.5 percent of GDP) in 2014 to $5 trillion (22.4 percent of GDP) in 2024, increasing by two-thirds before inflation. This is because entitlement spending grows on autopilot, driven by demographic and economic factors.

Rising deficits beginning in 2016 will send the publicly held debt to 79.2 percent of GDP by 2024. And the debt subject to the limit, which includes borrowing from the Social Security and Medicare trust funds, is projected to exceed $27 trillion at the end of the decade. Washington’s failure to handle the problem responsibly means a higher tax burden and a slower economy for younger generations.

Meanwhile, the debt limit suspension granting Washington unlimited borrowing authority since October will expire before the end of the week. Taxpayers will know by February 8th just how much more debt Congress and the President have piled onto their children and grandchildren.

But don’t expect President Obama to show leadership on reforming the entitlements and fixing the debt. Apart from boasting about the short-term reduction in the deficit, President Obama sent a strong signal in his State of the Union that his “year of action” would not extend to controlling spending and the debt. And spend-happy lawmakers will go right along with the President’s lack of leadership on one of the nation’s most pressing issues.