Many are proposing that tax rates for upper-income earners go back to their levels during the Clinton Administration. What you don’t hear is how we can return to Clinton-era spending levels. That would be a real solution to the upcoming fiscal crisis, and the President could lead the way.

The President says he wants Clinton-era marginal tax levels for families and small businesses earning more than $250,000 a year ($200,000 for individuals). However, tax rates for these earners would actually go up much more because of Obamacare tax hikes already signed into law.

Never mind that this would slow growth and hurt job creation. And no, these tax hikes won’t balance the budget—not next year, not the year after, not ever. Under Obama’s budget, federal debt would continue growing by $7.7 trillion even if the President gets his favorite tax hikes.

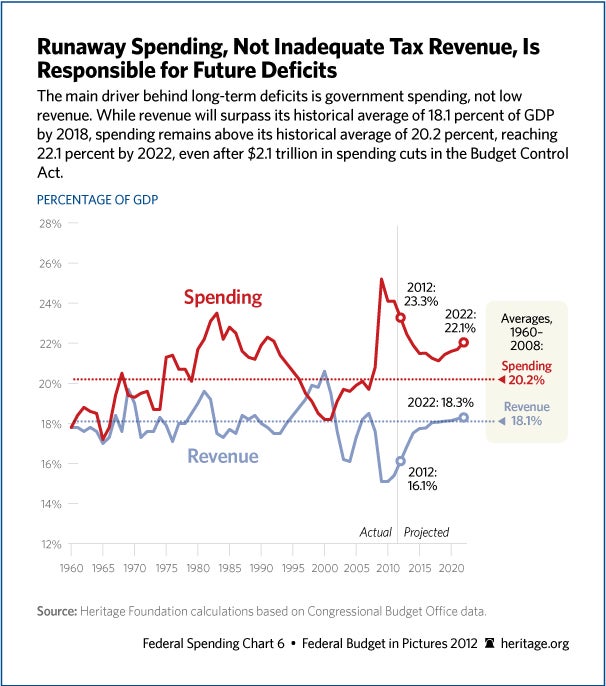

The debate over tax hikes is just a distraction from what is really going on: Washington has a spending problem, not a revenue problem, and President Obama is at the helm. According to the White House Office of Management and Budget, President Obama’s two-term average spending level is projected at 23.4 percent of gross domestic product (GDP).

In comparison, President Clinton’s historical spending average was 19.9 percent of GDP. While revenues are set to return to historical average levels of over 18.1 percent as the economy slowly recovers, spending under current policy is projected to remain well above the historical average of 20.2 percent.

The solution to America’s spending-driven debt crisis is as clear as daylight: Lawmakers must cut spending today and in the future. The Heritage Foundation has a plan, Saving the American Dream, which shows how lawmakers can balance the budget in less than 10 years and reduce the debt by tackling the main drivers of federal spending—entitlements.

A recent paper by Heritage’s J. D. Foster and Alison Fraser draws upon the Heritage plan to present the President with some simple but profound common-sense reforms to programs such as Social Security and Medicare that he could pursue today:

[T]he President must adopt the mantle of leadership, rather than brinksmanship, to steer the nation away from the fiscal cliff and all that is set to follow, and he must start with spending. However, the critical silver lining is that simple, commonsense, and thoroughly vetted solutions…constitute a strong start on the journey to more complete programmatic reforms remedying acknowledged flaws in these programs, and they already enjoy broad support across the political spectrum.

Click here to see the full list of proposals to avoid the fiscal cliff and avert the upcoming fiscal crisis.