The one glaring omission in President Obama’s fiscal cliff demands for higher rates on top earners is that he’s already raised their taxes. That’s right! When he signed Obamacare into law, he raised tax rates on families earning more than $250,000—his definition of rich.

He has done so by including in the 18 separate Obamacare tax hikes an increase of the tax rates on income and investment.

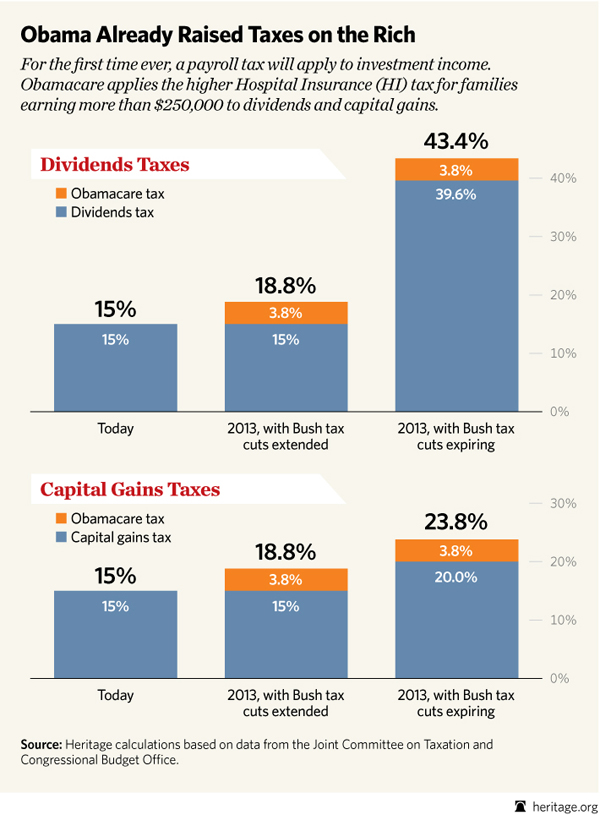

Obamacare raises the hospital insurance (HI) portion of the payroll tax on wage income over $250,000 from 2.9 percent to 3.8 percent. And it applies that 3.8 percent rate to investment income—capital gains and dividends—for those with incomes above that level. This is a massive policy change, since it represents the first time the payroll tax will apply to investment income. And even though this investment income HI tax would apply only to top earners, it is a dangerous step down a slippery, tax-hiking slope.

These economically damaging tax hikes will go into effect on January 1, 2013. When they do, the economy will suffer, because incentives to work and invest will fall. Less work and investment will mean that businesses create fewer jobs and pay their existing workers less than they otherwise would have.

Obama’s plan to raise rates further by allowing the Bush-era tax policies to expire for the same taxpayers he already hit with his Obamacare tax rate hikes would only exacerbate the economic damage.

Obama is fond of arguing that his plan for taxing the rich would just be going back to the rates we had under President Clinton. That is flat out incorrect. He again forgets that he signed Obamacare into law.

When factoring in the Medicare tax, the top income tax rate under President Clinton was 42.5 percent. Because of the HI tax increase in Obamacare, it would be 43.4 percent next year—but part of it will be hidden in the Medicare payroll tax.

The disparity between the Clinton rates and Obama rates would be even greater on investment. If Obama gets his way, the rate on capital gains would go to 23.8 percent when adding in the Obamacare surtax. The rate was 20 percent under Clinton. For dividends, the rate almost triples from 15 percent this year to 43.4 percent next year. Under Clinton, the dividends rate was 39.6 percent. (continues below chart)

In total, President Obama’s tax rate increases on upper-income earners in Obamacare will raise taxes by almost $318 billion over the next 10 years. But apparently that isn’t enough to satisfy the President’s ravenous appetite for even more revenue extracted from the small businesses and investors that help create the jobs the country desperately needs right now.

Beware the President’s demands for another round of tax increases on high-income earners, whether through higher rates or limiting deductions, exemptions, and credits. The hunger for higher taxes will never be satisfied, nor will it ever do anything to stop our impending debt crisis.