In one of heaven’s sweeter ironies, President Obama today launched the defense of his fiscal cliff proposal at a factory that makes…tinker toys. The setting perfectly reflected the Administration’s level of seriousness about the budget.

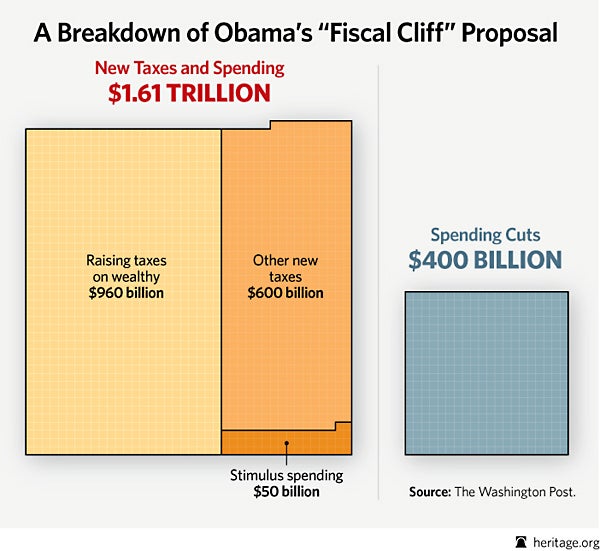

The “plan,” presented to Republican leaders yesterday, consists of $1.6 trillion in tax hikes over 10 years and unspecified spending cuts that “could total” $400 billion over the same period. So estimating liberally, the package consists of at least $4 of tax increases to $1 of spending cuts—and that’s if the promised spending reductions do materialize (which is far from certain). This is the Obama definition of “a balanced plan.”

It gets better. Even before these phantom savings come in, the President starts spending them: $25 billion to extend Medicare physicians’ payments and another $30 billion for extended unemployment insurance—both of which are part of the fiscal cliff. He also wants $50 billion for more economic “stimulus” (how’s that been working out so far?) and an unnamed amount for new mortgage refinancing relief.

Put simply: Spend now, save later.

About all of this, a few points:

First, the emphasis on tax hikes first is totally misguided—and has been from the beginning. The main driver of government deficits and debt is spending. Spending is how government does what it does. It is the root cause of all other fiscal consequences and the reason government taxes and borrows. Therefore, controlling spending is the key to controlling the budget. Spending restraint should be the focus of these negotiations.

Second, controlling spending requires restructuring government entitlements—especially Medicare, Medicaid, and Social Security. Obama and his allies refuse to face this fact, preferring to demagogue those who would “slash” these programs. The best way to ensure such cuts, however, is to leave these programs alone; they will collapse under their own weight.

Third, the task at hand is the “fiscal cliff”—the $500 billion in tax increases and $110 billion in across-the-board spending cuts (sequestration) scheduled to start in January 2013. In the few weeks left till the New Year, Congress and the President should attend to those issues and leave the rest for next year, under regular budget procedures.

As it happens, way back in May, House Republicans adopted a plan to avoid the cliff, though they seem too modest these days to discuss it. Their package—written in legislative language and accompanied by formal estimates from the Congressional Budget Office—replaced the crude sequestration mechanism with specific policy reforms, including Medicaid and food stamps. It would have prevented the current crisis and also placed a down payment on needed entitlement reform. It could have formed a reasonable starting point for negotiations (and still could).

The President and the Senate, however, simply ignored the proposal while offering no alternative of their own—exercising passive-aggressive neglect of their fiscal responsibilities.

There is still time to fix the current dilemma, but time is running short. There are “Six Bipartisan Entitlement Reforms to Solve the Real Fiscal Crisis”—the President only needs to seize the moment and lead. If, instead, the President and his allies continue their frivolous tactics, they will provide a whole new definition of the term “lame-duck session.”