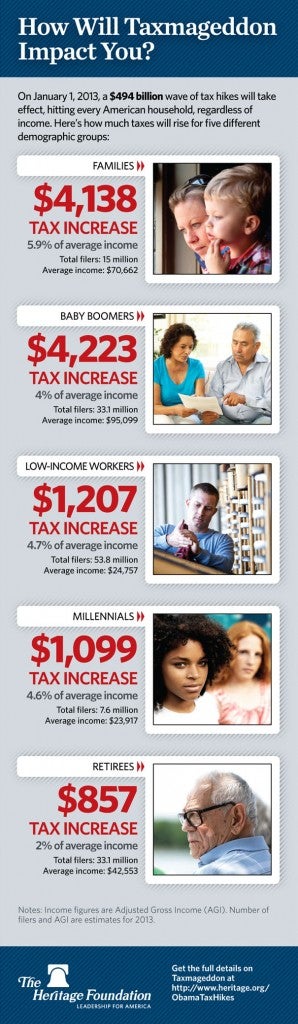

On January 1, 2013 nearly $500 billion in tax hikes will go into effect.

In other words, “Taxmageddon.”

Separating truth from fiction in politics, however, is not as clear, as The Heritage Foundation’s Curtis Dubay and Romina Boccia point out in last week’s analysis of the vice presidential debate:

About 120,000 high-income families would get an additional $500 billion tax cut over 10 years.

Biden: “120,000 families by continuing that tax cut will get an additional $500 billion in tax relief in the next 10 years.”

False. This is not a tax cut. It is the absence of a tax hike. Not raising taxes on high earners, who actually happen to be job creators, is not the same as cutting their taxes. President Obama and Vice President Biden have a troubling habit of arguing their case in this way. It is troubling because to take that stand is to presuppose that the money we all earn is actually the government’s in the first place. Hopefully they don’t really believe that to be the case.

Only when the government presupposes–as Dubay and Boccia write–that the money earned by those 120,000 families rightfully belongs to the government and not the families themselves does avoiding a tax hike become a tax cut.

From Dubay’s July 2012 issue brief on Taxmageddon:

Taxmageddon is causing widespread uncertainty that is slowing the economy right now,[6] and, if it hits on January 1, 2013, the blow it would deliver to the already staggering economy would be severe.

Congress should not delay stopping Taxmageddon by engaging in unnecessary attempts to pay for phantom revenue losses. Congress should evaluate stopping Taxmageddon against a current policy baseline, which would clearly show that stopping Taxmageddon is not a tax cut and does not raise the deficit and that therefore Congress does not need to pay for stopping it. The sooner it realizes this and votes to stop Taxmageddon, the better.

Here’s a look at Taxmageddon’s tax hikes, and how Taxmageddon would affect you:

Heritage Foundation calculations based on data from the Congressional Budget Office and Office of Management and Budget.