As states weigh their options regarding the Obamacare expansion of Medicaid, many have sought out cost estimates to assist them. However, in a new paper, Heritage experts Ed Haislmaier and Drew Gonshorowski caution state lawmakers that state cost estimates rest on key assumptions, some of which may be questionable.

There are six reasons state cost estimates could be unreliable:

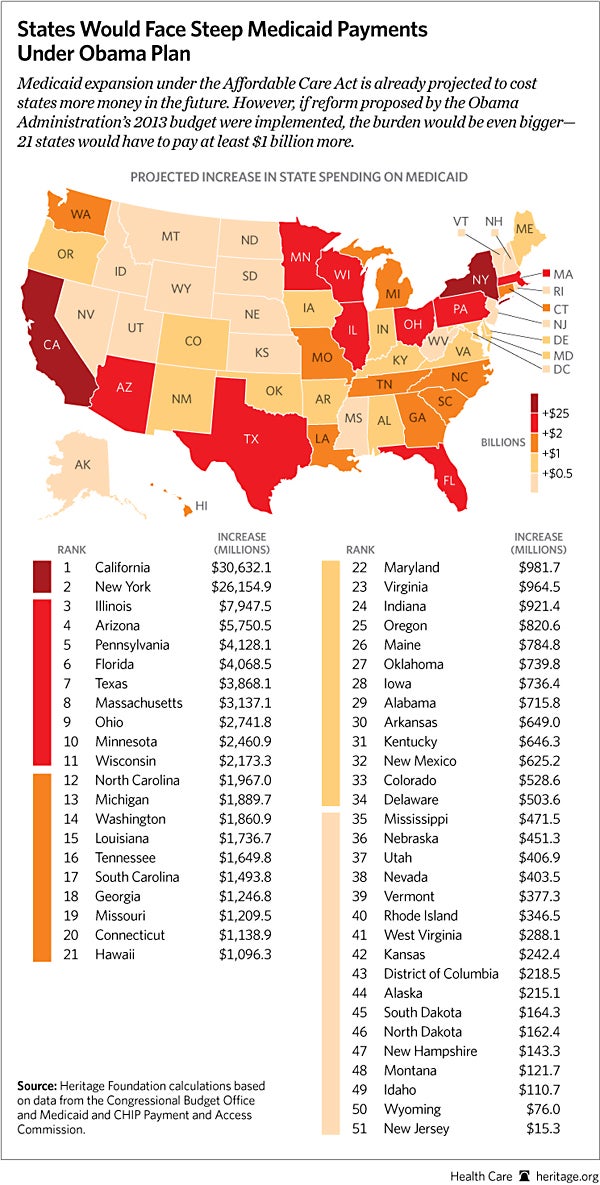

- The Medicaid federal match rate could be lower in the future. As it stands now, the federal government is supposed to pay at least 90 percent of the expansion costs. However, the President’s fiscal year 2013 budget has already proposed a change to Medicaid federal match rates beginning in 2017, turning it into a blended rate that would encompass Medicaid, CHIP, and the new expansion population. The Administration projects that it would cost states an extra $3.4 billion a year. Even though the blended rate has yet to be determined, it will undoubtedly put even more strain on state budgets. See the chart below and read Gonshorowski’s new paper to see different scenarios for each state.

- Reduced state spending on the uninsured is unlikely. Some estimates of state spending with a Medicaid expansion include savings from reduced spending on the uninsured. Haislmaier and Gonshorowski explain, “Under Obamacare, it is even more implausible to assume state savings from cutting uncompensated care payments, since any state payment cuts would have to be imposed in addition to Obamacare’s federal payment cuts.”

- Accounting for the “woodwork” effect. The “woodwork” effect refers to individuals that were eligible for, but not enrolled in, Medicaid under previous law and enroll in 2014 due to the expansion and new exchanges. This population would still receive the old federal match rate, not the increased rate of the expansion population, thus leading to greater costs for states.

- Higher administrative costs. Administrative costs add about 5.5 percent on top of Medicaid spending, with states’ share of that spending averaging around 45 percent. Obamacare’s Medicaid expansion will not increase the federal match for administrative costs but will nonetheless increase total administrative costs.

- Potential savings without an expansion. Any cost projection should include an estimate of the savings a state would incur if those persons between 100 percent and 138 percent of the federal poverty level were enrolled in the federally subsidized exchanges, where the federal government is responsible for all spending.

- The appropriateness of the tax revenue estimate. The authors explain, “In theory, new federal spending from the Obamacare Medicaid expansion will be income to someone (e.g., various health care providers) who will then pay state taxes on that income.” The assumptions that are made regarding the amount of new state tax revenue from that income determines how much a state will spend or save with a Medicaid expansion.

Haislmaier and Gonshorowski warn, “There is an old adage that if something seems too good to be true, it probably is. When it comes to studies purporting to show positive state fiscal effects from adopting Obamacare’s Medicaid expansion, state lawmakers should keep that folk wisdom in mind.”