The federal budget is reaching benchmarks of astronomical proportions. Hold your applause, though; the budget trends are increasingly headed in the wrong direction.

Yesterday, the Congressional Budget Office (CBO) reported that the deficit for fiscal year 2012 has surpassed the $1 trillion mark, and it anticipates the Treasury Department will report a $1.17 trillion deficit as of the end of August. The deficit can and will get worse, though, because a few weeks remain before the fiscal year ends on September 30th. Remember, too, that this marks the fourth year in a row with a $1 trillion plus deficit.

CBO’s report follows Treasury’s grim confirmation last week that the national debt reached the $16 trillion mark, engulfing the size of the entire U.S. economy. That translates into $51,000 in debt per U.S. citizen, about what the average American will earn this year. Because of Washington’s overspending, the debt continues to climb upward toward the $16.394 trillion statutory limit allowed under the Budget Control Act of 2011 (BCA).

Washington lacks the resolve to rein in federal spending, despite such negative report cards. Congress’ latest proposed spending bill, the FY2013 continuing resolution (CR) that will fund the government, doesn’t even freeze spending at current levels, as a typical CR would. The CBO estimates that level to be $1.039 trillion. Instead, lawmakers plan to increase discretionary spending by $8 billion, in order to reach the annual rate of $1.047 trillion provided under the BCA.

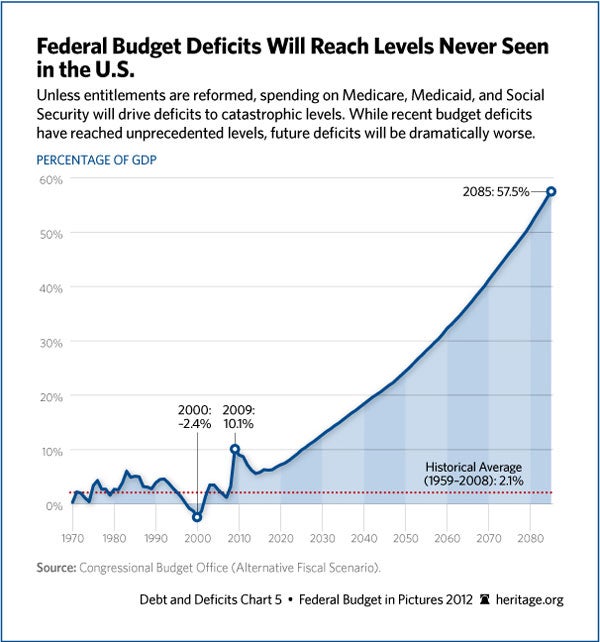

If the current state of the budget appears gloomy, the future could prove to be downright awful. Absent reforms to entitlement programs—especially Medicare, Medicaid, and Social Security—federal spending will skyrocket. Deficits will reach unprecedented levels during the next few decades, causing debt to increase to economically stagnating levels. Taxpayers will be left to deal with the consequences. (continues below chart)

Moody’s Investor Service today joined Standard & Poor’s in issuing a stern warning that it would likely lower the United States’ credit rating from AAA to Aa1, if Congress does not stabilize the debt-to-GDP ratio and address the coming fiscal cliff.

Congress needs to stop dithering and get spending under control.