The Wall Street Journal reports that America’s uncompetitive corporate tax code is driving U.S. businesses to relocate their headquarters to other countries. One of the major reasons these businesses are fleeing our shores is taxes.

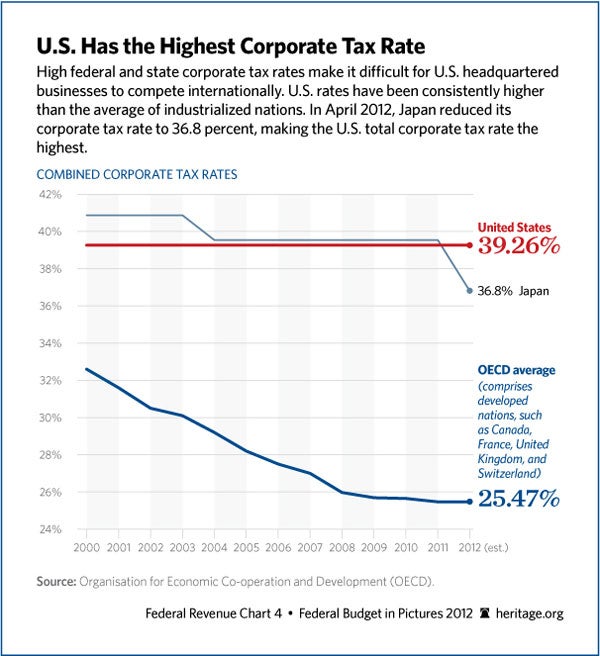

Each of the countries the article cites as places where U.S. businesses have moved their headquarters—the United Kingdom and Ireland, for example—is a nation with a lower corporate tax rate than the United States. This is wholly unsurprising, since the U.S. now has the highest corporate tax rate in the developed world. No matter where a U.S. business relocates its headquarters, it would face a lower rate.

In fact, the U.S. rate—the federal rate combined with the average state rate—is more than 39 percent. The average tax rate in other developed countries is 25 percent. The U.S. is an outlier in the wrong direction. To get competitive again, Congress and the states need to lower the combined rate to 25 percent, or preferably below.

Losing corporate headquarters is troubling for the economy and for the localities that lose those major parts of their communities. Just ask St. Louis now that Anheuser-Busch is a Belgian company, largely because of tax reasons. Just as troubling, however, is that because of our high corporate tax rate, the U.S. is missing out on new investment from both domestic and foreign-based businesses. The new investments these businesses are making are going to all those other countries with more competitive rates. This is costing our economy jobs every day.

It is way past time for Congress to correct our uncompetitive corporate tax system. The sooner the better because, as Congress delays, businesses will continue to take their investments and the jobs they create to other, more competitive countries.