How high is the marginal tax rate on each additional dollar the average American earns? In other words, if you got a raise of one dollar, how much of that dollar would be taxed away? These rates are already high, and they’re getting higher next year.

A middle-class taxpayer’s income is subject to a 25 percent federal income tax. Then there is the federal Social Security and Medicare payroll tax of 13.3 percent in 2012—5.65 percent of that is removed from the employee’s paycheck, and the remaining 7.65 percent is paid by the employer. (In reality, the employee pays the entire 13.3 percent, because the employer’s portion of the tax does not affect the cost of labor: The employer would pay the employee 7.65 percent more if there were no employer’s portion of the payroll tax.)

So the 25 percent federal income tax plus 13.3 Social Security and Medicare payroll taxes equals 38.3 percent going to federal taxes in 2012.

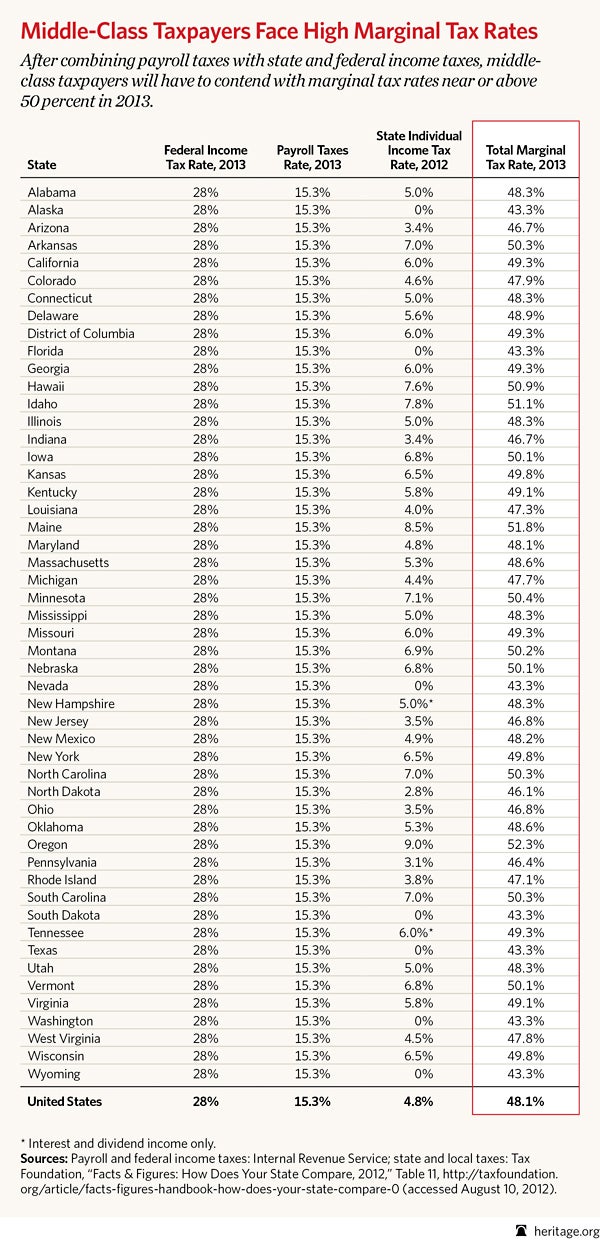

And then there are state taxes. According to the Tax Foundation, the average state’s income tax rate for the middle-class taxpayer is 4.82 percent, which brings the total to 43.12 percent in federal and state taxes. And it’s going higher, thanks to the nearly $500 billion in tax increases for 2013 that some have called Taxmageddon. In January of next year, the federal income tax rate for middle-class taxpayers is scheduled to rise from 25 percent to 28 percent, and the payroll tax is scheduled to rise from 13.3 percent to 15.3 percent. This drives the marginal tax rate based on the aforementioned three taxes to 48.12 percent. Add in state and local property, corporate, excise, and other state and local taxes, and the percentage of each additional dollar that is taxed hovers around 50 percent.

When half of each additional dollar earned is taxed away, taxpayers experience a disincentive to start businesses or expand existing ones. This leads to fewer jobs being created.

It is outrageous that any dollar earned by a middle-class taxpayer would go as much to taxes as to supporting the taxpayer’s family. The government didn’t earn the taxpayer’s paycheck and shouldn’t be entitled to it.

See the table below to see how your state compares to the national marginal tax rate of 43.1 percent in 2012 and 48.1 percent in 2013.