Today’s jobs report is a broken record, with the unemployment rate stuck at 8.2 percent. The Department of Labor reports that only 80,000 jobs were added in June—consistent with other data revealing the economy has downshifted from slow to slower. This picture is starkly different from the economy President Obama promised of a strong recovery and millions of “saved or created” jobs a few years ago.

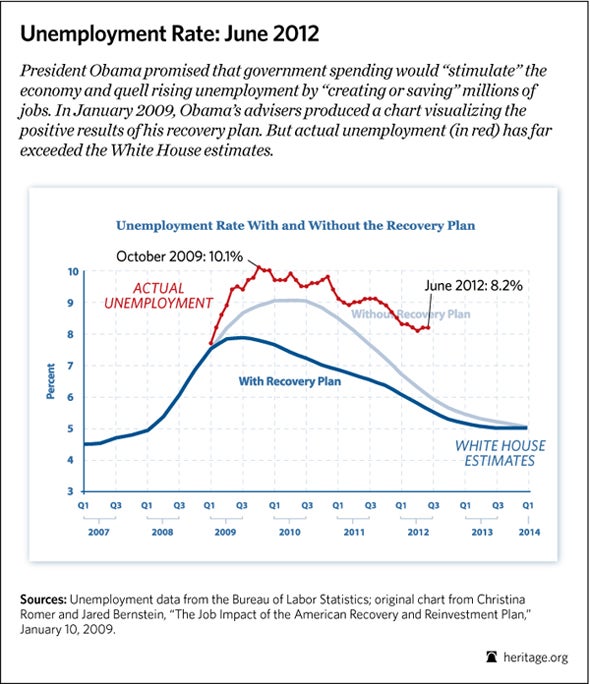

In 2009, the President promised that his “recovery plan” composed almost entirely of government spending was the only way to stave off rising unemployment. The White House even drafted a chart showing projected unemployment with the economic stimulus plan and without it—to scare lawmakers into voting for it. According to their projections, by now, unemployment should be at 5.5 percent. Instead, of course, it’s 8.2 percent—and has been above 8 percent for 41 straight months.

This jobs drought is the result of counterproductive policies, many of which could be reversed immediately. But in the meantime, employers aren’t hiring because they are suffering from prolonged uncertainty, as economists readily admit.

“When we get an increase in general uncertainty, employers tend to postpone investment and hiring decisions,” Michael Gapen, senior U.S. economist with Barclays, told CNNMoney.

That uncertainty, which is now made worse by the impending implementation of Obamacare, the economic meltdown in Europe, and slower growth in Asia, stems primarily from America’s date with Taxmageddon on January 1, 2013. The largest tax increase in U.S. history—$494 billion in one year—will hit on that day, as a host of tax cuts expire and new tax hikes (including some of Obamacare’s new taxes) take effect.

Taxmageddon falls primarily on middle- and low-income Americans. Heritage research shows that families will see an average tax increase of $4,138. Visit the new Taxmageddon page to see the impact of these tax hikes on individuals. It includes an interactive map where you can click on your state to see what the average tax increase will be.

Though it doesn’t officially hit until January 1, Taxmageddon is having a real effect on job creation right now. Small business owners cite taxes as their single greatest problem, even ahead of poor sales.

“Companies and households won’t know what their tax liabilities are going to look like in 2013, what the regulatory or spending backdrop is. It’s going to be an uncertainty which weighs on people’s ability to make plans,” Julia Coronado, chief North America economist at BNP Paribas in New York, told Reuters.

The President should be leading the country in the opposite direction—giving employers and individuals the assurance that these tax hikes will be prevented. Instead, in his 2013 budget submission, the President called for $2 trillion in tax increases, and he has showed no signs of saving Americans from Taxmageddon. Indeed, he’s been almost silent on the impending avalanche of taxes, except to endorse higher rates for investors and business owners.

Last year, Congress prevented some tax increases just in the nick of time. The longer Congress waits to prevent Taxmageddon, the more uncertainty there will be for workers and businesses. This is an element of the economy that is actually in the complete control of American policymakers. They should act quickly to increase certainty and stability at a time when the economy greatly needs it. If the President will not lead, Congress should step up and show the public that at least one branch of government cares about creating jobs and growing the economy.

Quick Hits

- The House Rules Committee has scheduled an “emergency” meeting for Monday to consider a measure that would repeal Obamacare.

- Obama Transportation Secretary Ray LaHood hailed China as a model for government efficiency this week, saying: “The Chinese are more successful [in building infrastructure] because in their country, only three people make the decision. In our country, 3,000 people do, 3 million.”

- The New York Times reports that “in the heat of an election year, the Obama administration has maneuvered around Congress, using the waivers to advance its own education agenda.” The Administration continues to give states waivers from the requirements of No Child Left Behind.

- New reports reveal that former Senator Chris Dodd (D-CT) referred others to a secret VIP mortgage program from subprime lender Countrywide that he repeatedly denied knowledge of.

- Join Heritage at noon today for our lunchtime chat with Jennifer Marshall. She will be taking your questions about what Obamacare means for religious freedom, what can be done now, and recent “Fortnight for Freedom” events.