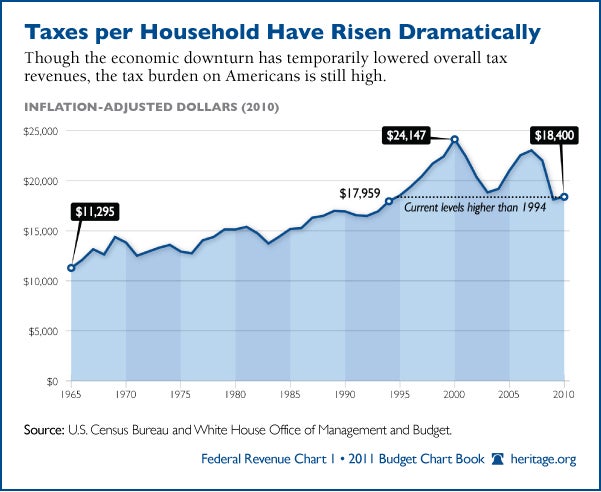

Americans who are scrambling to pay their taxes by Tuesday’s deadline are in store for more depressing news: The tax burden on American families has risen dramatically and will continue to climb into the future without action from Congress. This week’s chart outlines the growth of taxes over the past 45 years.

Large tax increases are just months away. Jan. 1, 2013, is already being dubbed Taxmaggedon. Seven existing tax policies will end and 18 new taxes from Obamacare will begin, leading to a $494 billion tax increase at the start of next year. Heritage tax expert Curtis Dubay warned about the consequences:

Although these tax increases will not start raising new revenue until next year, they are having a negative impact on the economy today. Families, businesses, and investors need to know how much tax they will pay in the future before making important economic decisions. The uncertainty caused by Taxmageddon means they are stuck in neutral while they wait for President Obama and Congress to act. This is slowing job creation and stopping many of the millions of unemployed Americans from going back to work.

To relieve Americans from the large tax burden, Obama and Congress should remove the threat of Taxmageddon now. “That would assure families, businesses, and investors that their taxes will not rise sharply as the economy is still staggering to its feet and show the voters that Washington really can get important things done—even in an election year,” Dubay wrote.

Americans are already paying significantly more than they did in 1965, when Great Society programs like Medicare and Medicaid were created. Without action, this historical trend is likely to continue.