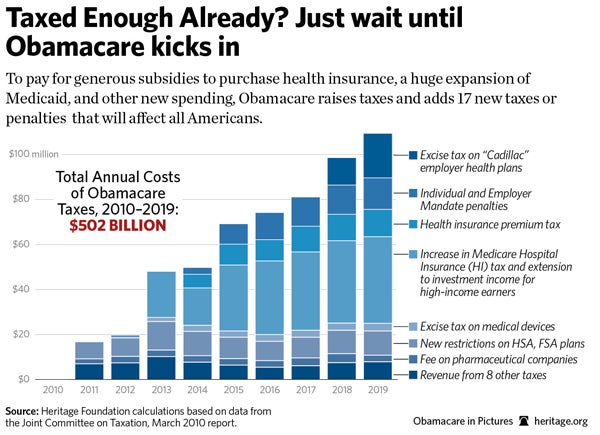

Americans who feel overtaxed already are in store for a shocker: Obamacare will add 17 new taxes or penalties for a whopping cost of $502 billion over its first 10 years.

This week’s chart illustrates the new taxes and offers a year-by-year rundown of their annual costs. These taxes will pay for generous subsidies, an expansion of Medicare and new government spending.

A notable jump in Obamacare taxes comes in 2013, a result of Medicare Hospital Insurance tax and an increase in taxes on investment income for high-income earners.

“If you and your spouse earn more than $250,000 a year (or you alone earn $200,000 or more), your Medicare payroll tax will increase from 2.9 to 3.8 percent. This new tax will raise $210 billion for Obamacare,” the authors of “Why Obamacare is Wrong for America” wrote.

Then in 2014, a new tax is introduced for health insurance premiums. That year also marks the start of the individual and employer mandate penalties, which are projected to generate about $120 billion in revenue.

The last notable tax arrives in 2018: an excise tax on “Cadillac” employer health plans. It is expected to produce $32 billion in revenue to pay for Obamacare.

These tax increases will have negative economic effects because they transfer resources from the private sector to government, according to Heritage’s Curtis Dubay, who documented each tax and its cost.

“As a result, the tax hikes in [the Patient Protection and Affordable Care Act] will slow economic growth, reduce employment, and suppress wages. These economy-slowing policies could not come at a worse time. PPACA tax increases will impede an already staggering recovery,” Dubay wrote in an analysis of the Obamacare taxes.

View more charts and graphs about Obamacare’s far-reaching negative effects on Americans in our newly released “Obamacare in Pictures: Visualizing the Effects of the Patient Protection and Affordable Care Act.”