The most significant numbers in today’s updated estimates from the Congressional Budget Office (CBO) are not the official “baseline” figures. More important are CBO’s “alternative” projections, which make clear once again that too much spending—not too little tax revenue—is the biggest threat to the country’s fiscal and economic health. Among other things, the alternative figures show that:

- Federal spending will consume record levels of resources as a share of the economy, reaching nearly one-quarter of gross domestic product (GDP) in 2022.

- Without tax increases, tax revenue would still reach its historical average, but uncontrolled spending would outpace revenue. This would push federal debt to levels that the CBO calls “unsupportable.”

CBO’s conventional baseline (defined by statute) projects spending, tax revenue, and deficits assuming current law—including scheduled changes in law. This includes an expiration of the “doc fix,” which has prevented a plunge in Medicare physician reimbursements every year since 2003, and the expiration of the Bush-era tax policies, as well as a number of other tax provisions. These would result in a tax increase of about $4 trillion over the next 10 years. These assumptions represent what CBO calls “a significant departure from recent policies.” That is, no one expects these changes to happen; even President Obama would not raise taxes this much.

Further, if all these tax increases did occur, CBO projects—unrealistically—that tax revenue would climb above 20 percent of gross domestic product (GDP) in 2015 and continue to exceed that level through the rest of the decade, reaching 21.2 percent in 2022. But federal taxes have never held at that level for that long. In more than 70 years, federal tax revenue has topped 20 percent of GDP only three times: in 1944, 1945, and 2000. It would be a dramatic change if U.S. taxpayers tolerated taxes that high for any extended period, and the economy would not sustain them without sacrificing jobs and growth.

Because CBO knows its baseline projections vary greatly from any likely budget policy, its report today contains an alternative scenario based on more likely policy choices. This alternative would extend all current tax policies (except the current reduction in the payroll tax rate), index the alternative minimum tax (AMT) for inflation to prevent it from ensnaring an ever-growing number of taxpayers, extend the doc fix, and prevent automatic spending cuts from sequestration starting in January 2013 as required under the Budget Control Act.

Without tax increases, these projections show federal revenue reaching 18.1 percent of GDP—its historical average level—in 2016 and then continuing to grow as a share of the economy, reaching 18.5 percent of GDP in 2022.

Government spending in this scenario outpaces these growing tax revenues by substantial amounts, exceeding 23 percent of GDP for most of the decade (its lowest level is 22.9 percent of GDP) and reaching 24.3 percent in 2022. As a result, deficits never fall below $883 billion and would reach $1.45 trillion in 2022. Debt held by the public also continues rising, from 73.3 percent of GDP today to an alarming 93.2 percent in 2022.

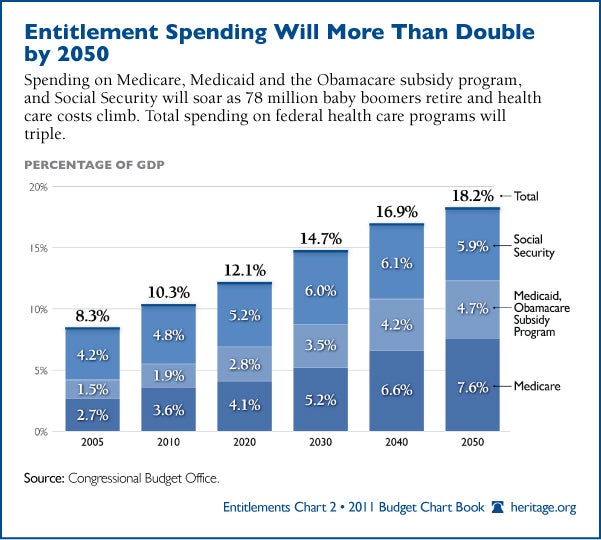

In both budget scenarios, Medicare, Medicaid, and Social Security are still the driving forces behind unsustainably higher spending. “Under both CBO’s baseline and its alternative fiscal scenario, the aging of the population and rising costs for health care will push spending for Social Security, Medicare, Medicaid, and other federal health care programs considerably higher as a percentage of GDP,” today’s report says. At historical tax revenue levels, “the resulting deficits will push federal debt to unsupportable levels.”

This is yet another warning about the government’s reckless fiscal policy. Congress and the President should heed it and start taking action to correct the problem.