In a recent article titled “Hill Weighs Tax Trade-offs,” Politico reports that Congress is considering lowering the corporate tax rate and replacing the lost revenue with higher tax rates on capital gains and dividends. But the article cites no “Hill sources” considering such an ill-conceived swap.

There are only vague quotes at the very end of the article from Senators Rob Portman (R–OH) and Max Baucus (D–MT) about the need for corporate tax reform—hardly an endorsement of the plan. This unwise plan has legs only in the minds of the plan’s authors and Politico reporters.

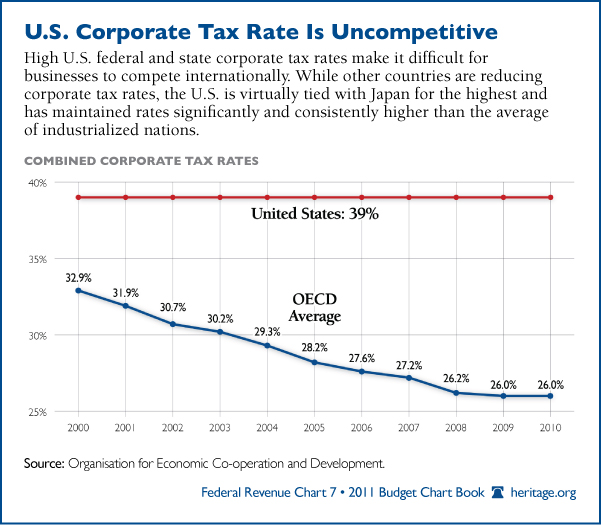

The plan originates not from congressional sources but from a report by three economists. Politico writer David Rogers devotes a substantial portion of his article to detailing the report and citing its main author, the widely respected Roseanne Altshuler. The plan calls for Congress to lower the corporate tax rate to 26 percent and replace the revenue lost from that rate cut by raising the capital gains rate from the current 15 percent to 28 percent. The dividends rate would also rise from its present 15 percent rate to ordinary income tax rates—43.4 percent starting in 2013.

It is a step in the right direction that so many are exploring the options and consequences of corporate tax rate reduction, including President Obama, now that he has released his corporate tax reform “framework.” The U.S. badly needs to lower its rate to put our largest businesses on equal footing with their global competitors. But paying for a corporate tax rate reduction with higher tax rates on capital gains and dividends would be one step forward and one giant step back.

A lower corporate rate is necessary to improve international competitiveness and to lower the cost of capital, which increases incentives for investment. Higher rates on capital gains and dividends would raise the cost of capital and largely wipe out the gains from a lower corporate rate, leaving the economy no better off than before the rate switcheroo.

Reducing the corporate income tax rate substantially is important, but revenue-neutral reform may prove more difficult than some expect. Every idea is worth considering, but some should be considered only for a moment before being set aside. Raising the capital gains and dividend tax rates is one such discardable notion.