This year’s Index of Dependence on Government presented startling findings about the sharp increase of Americans who rely on the federal government for housing, food, income, student aid or other assistance. (See last week’s chart.)

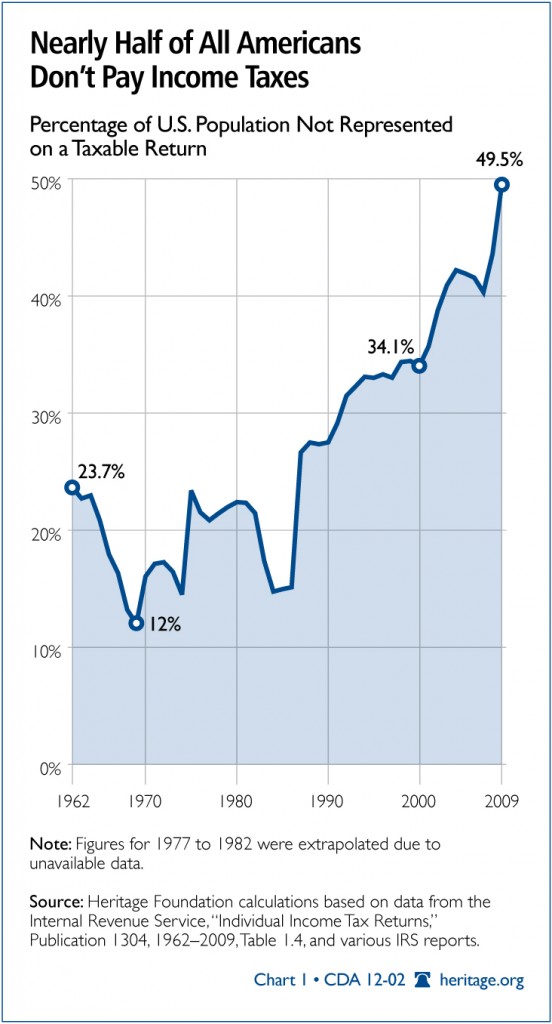

Another eye-popping number was the percentage of Americans who don’t pay income taxes, which now accounts for nearly half of the U.S. population. Meanwhile, most of that population receives generous federal benefits.

“One of the most worrying trends in the Index is the coinciding growth in the non-taxpaying public,” wrote Heritage authors Bill Beach and Patrick Tyrrell. “The percentage of people who do not pay federal income taxes, and who are not claimed as dependents by someone who does pay them, jumped from 14.8 percent in 1984 to 49.5 percent in 2009.”

That means 151.7 million Americans paid nothing in 2009. By comparison, 34.8 million tax filers paid no taxes in 1984.

The rapid growth of Americans who don’t pay income taxes is particularly alarming for the fate of the American form of government, Beach and Tyrrell warned. Coupled with higher spending on government programs, it is already proving to be a major fiscal challenge.

“This trend should concern everyone who supports America’s republican form of government,” Beach and Tyrrell wrote. “If the citizens’ representatives are elected by an increasing percentage of voters who pay no income tax, how long will it be before these representatives respond more to demands for yet more entitlements and subsidies from non-payers than to the pleas of taxpayers to exercise greater spending prudence?”