President Obama used his State of the Union address Tuesday to outline his idea of fairness. To put it simply, that means redistributing wealth by raising taxes on the most successful Americans.

“If you make more than $1 million a year, you should not pay less than 30 percent in taxes,” Obama declared. He added: “Now, you can call this class warfare all you want. But asking a billionaire to pay at least as much as his secretary in taxes? Most Americans would call that common sense.”

Heritage’s Curtis Dubay challenged Obama’s characterization of the so-called “Buffett Rule.” Dubay said it was a fallacy.

“The President can claim success on this one even before he ends his speech tonight because the Buffett Rule is already soundly in place,” Dubay wrote in response to Obama’s speech. “According to the CBO, the top 1% of income earners pay 30 percent of their income in all federal taxes.”

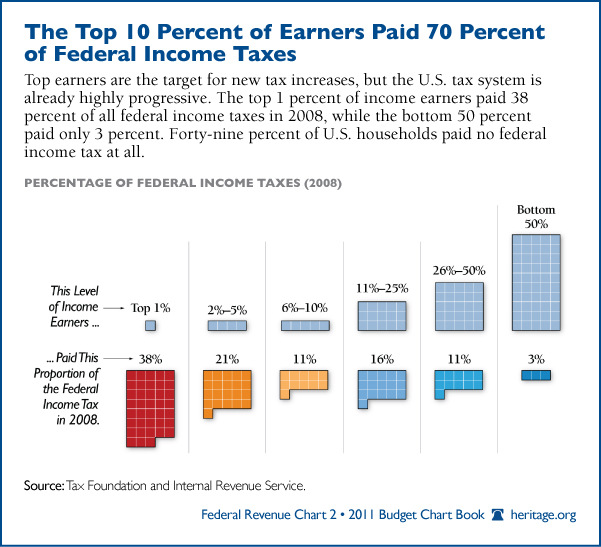

This week’s chart reveals the top 10 percent of income earners paid 70 percent of all federal income taxes in 2008, while the bottom 50 percent paid only 3 percent. Remarkably, 49 percent of U.S. households paid no federal income tax at all.