Following the failure of the Joint Select Committee on Deficit Reduction, Sen. Pat Toomey (R-PA) criticized liberals for insisting that any deal include a massive tax hike. In a speech at Heritage last week, he said tax revenue isn’t the problem facing the United States in the future; it’s the massive increase in federal spending.

“It’s actually arithmetically impossible to solve this problem on the tax side alone,” said Toomey, who noted that Democrats on the Super Committee wanted to hike taxes by $1 trillion without making any fundamental reforms to curb unsustainable entitlement programs.

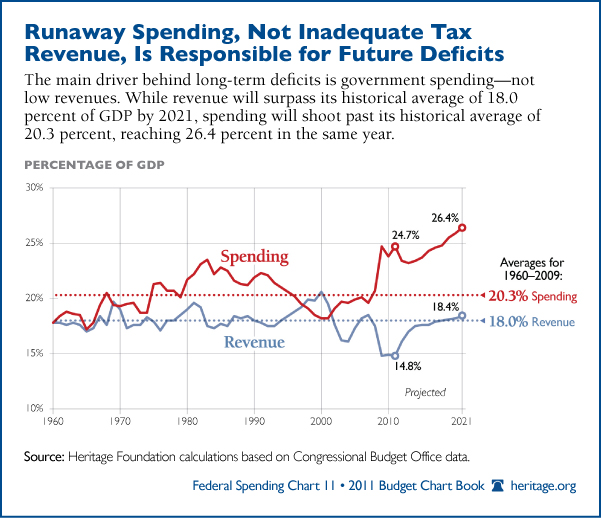

Toomey cited data from the Congressional Budget Office to make his case. Heritage’s 2011 Budget Chart Book uses that same data to depict how government spending — not inadequate tax revenue — is the main driver of long-term deficits.

This week’s chart shows how spending will skyrocket beyond its historical average of 20.3 percent of the U.S. economy, reaching 26.4 percent by 2021. Revenue, meanwhile, will surpass its historical average of 18 percent of GDP in the same year, according to Heritage Foundation calculations based on CBO data.

Toomey was correct in his analysis of the debt crisis. As he said at Heritage, “A trillion-dollar tax increase … would be devastating to the economy, doesn’t solve the problem and would be the wrong way to go.”