With the failure of the super committee to recommend at least $1.2 trillion in deficit reduction, Congress’s latest attempt at budget control has collapsed. There will be many analyses of why the process did not work, but it’s worth stepping back to recall what generated the need for this extraordinary procedure and what the exercise actually produced.

From early in the year, it was generally accepted that the divided Congress would be unable to agree on a budget through regular procedures. Republicans chose to use a necessary vote on the debt limit to force the Administration to face the need for spending reductions. After a summer-long debate, rife with hyperbole about a potential government “default,” the Budget Control Act of 2011 (BCA) was born, crafted in a way that at face value expressed the goal of fiscal prudence.

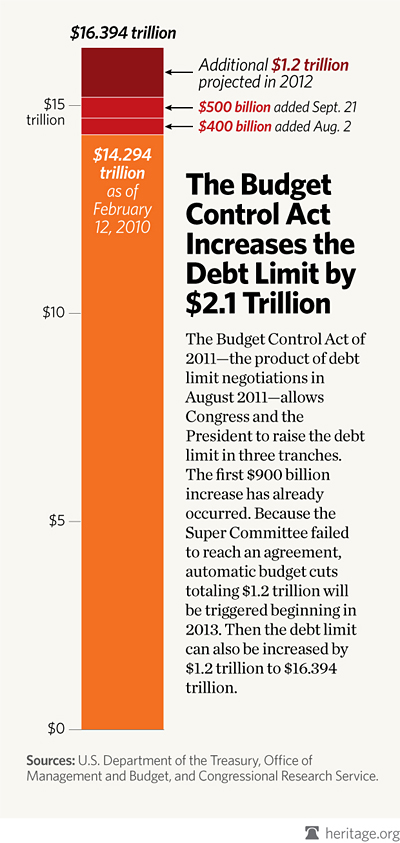

The BCA both imposed a set of discretionary spending caps to limit annually appropriated spending and established the super committee to recommend policies that would reduce the deficit by at least an additional $1.2 trillion through 2021. In return, the BCA included debt limit increases in three tranches: $400 billion, $500 billion, and then $1.2 trillion, as the chart below illustrates.

The debt limit hikes were ostensibly contingent on deficit reduction and a vote on a balanced budget amendment to the Constitution. But in fact, under the language of the BCA legislation, they could be blocked only if Congress passed a joint resolution of disapproval. If passed, such a resolution would be subject to a presidential veto, requiring the usual two-thirds vote of both houses to override. Thus these debt ceiling increases up to $2.1 trillion were all but assured from the beginning. (Article continued below chart)

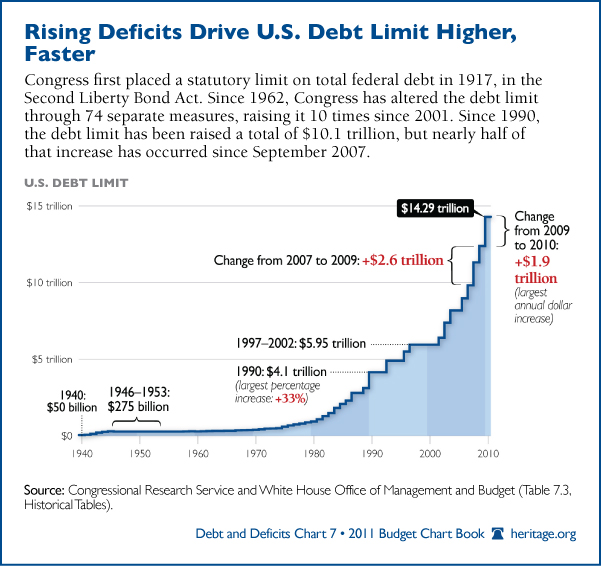

The first two increases totaling $900 billion have already occurred, and the debt limit now stands at an astounding $15.124 trillion. It is up from the $14.29 trillion limit set in early 2010 and follows a history of frequent and growing debt limit increases, as shown in this Heritage Budget Chart Book chart. (Article continued below chart)

The third increase of $1.2 trillion—projected to occur early in 2012 when the debt begins to again encroach upon the limit—would raise the debt limit to an unprecedented $16.324 trillion, or over 100 percent of GDP.

Thus, the debt limit will climb ever higher, accommodating the profligate spending of the President and Congress. As Heritage’s J. D. Foster wrote in January: “The need to raise the debt limit reflects an intention to continue deficit financing” and should signal to Congress that it should urgently reexamine its current policy decisions.

Policies that promote reckless spending—forcing the government to borrow about 40 cents of every dollar it spends, while pushing total debt past 100 percent of gross domestic product (GDP)—are flat-out irresponsible. This upward trajectory makes it crystal clear that the government’s spending priorities have deviated severely from what the Founders laid out in the Constitution.

Equally disappointing, both the existing spending caps and the automatic enforcement in the BCA are less than advertised. The caps contain flaws that may make them all but meaningless. The “sequester” mechanism that would impose spending cuts will not be triggered until January 2013, giving Congress plenty of time to rewrite or abandon it.

As The Heritage Foundation’s David Addington writes, “The overspending problem is still here. Congress must still act to get the federal spending under control, in a thoughtful, intelligent manner that meets the needs of the American people.” It should do this without succumbing to pressure to hike taxes on Americans and further weigh down an already struggling economy. Remember, the problem is Washington’s spending.

Congress should demonstrate that it is serious about tackling the problems of rising spending, debt, and deficits. That means reforms to Medicare, Medicaid, and Social Security; transforming the maddeningly complicated tax system; and reducing the size and scope of government. In Saving the American Dream, The Heritage Foundation offers the kinds of bold solutions needed to put America back on a path toward fiscal sustainability and economic prosperity.