Conventional wisdom has it that China’s growing economy poses a serious threat to America’s status as a global economic superpower. The media and politicians repeat time and again that the United States is losing much of its manufacturing base to China and that American jobs are disappearing as a result. Many Americans who believe these claims vote for politicians who promise to “protect” American jobs from foreign competition.

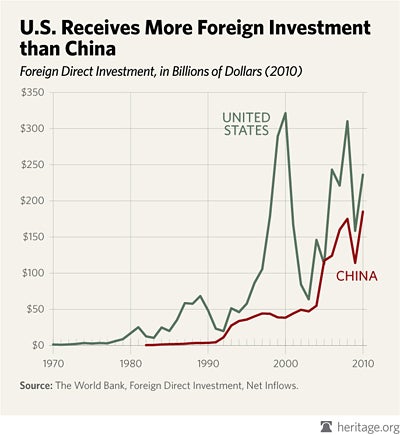

A look at the numbers reveals that, contrary to the assertion that corporations prefer to invest in low-wage countries like China, the United States is the world’s strongest magnet for investment dollars. Look at recent trends in foreign direct investment (FDI), which measures investment in factories and other enterprises, as opposed to indirect investment in stocks and bonds.

According to the World Bank, FDI in America has been higher than FDI in China every year except one since 1970. The exception was in 2005, when FDI in China for the year was about $4.57 billion more than FDI in America. Since then, foreign investors have funneled 54 percent more money to the United States than to China. China has received $759 billion in new FDI since 2005, while the United States has received nearly $1.17 trillion.

In 2010, even as commentators complained about jobs being outsourced from the United States to China, foreign investors continued to favor the United States, pouring $236.2 billion into the U.S. economy—about 28 percent more than they sent to China.

Although scary stories about U.S. jobs being outsourced to China continue to make headlines, these numbers reveal that international investors consistently prefer to send their job-creating dollars not to China, but to the United States.

Charles Kaupke is currently a member of the Young Leaders Program at The Heritage Foundation. For more information on interning at Heritage, please visit: http://www.heritage.org/about/departments/ylp.cfm